eyewall41

All American

2253 Posts

user info

edit post |

http://www.pewsocialtrends.org/2013/04/23/a-rise-in-wealth-for-the-wealthydeclines-for-the-lower-93/

In just 2 years the net worth of the bottom 93% fell by 4% from 2009-2011. At the same time the net worth of the top 7% skyrocketed by 28%. Trickle down is a scam...

During the first two years of the nation’s economic recovery, the mean net worth of households in the upper 7% of the wealth distribution rose by an estimated 28%, while the mean net worth of households in the lower 93% dropped by 4%, according to a Pew Research Center analysis of newly released Census Bureau data.

From 2009 to 2011, the mean wealth of the 8 million households in the more affluent group rose to an estimated $3,173,895 from an estimated $2,476,244, while the mean wealth of the 111 million households in the less affluent group fell to an estimated $133,817 from an estimated $139,896.  6/4/2013 9:25:38 AM 6/4/2013 9:25:38 AM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

But the poor have refrigerators, thesis destroyed  6/4/2013 11:24:14 AM 6/4/2013 11:24:14 AM

|

MisterGreen

All American

4328 Posts

user info

edit post |

it's capitalism, cry some more  6/4/2013 11:31:33 AM 6/4/2013 11:31:33 AM

|

mrfrog

☯

15145 Posts

user info

edit post |

To an extent, this is a story about the stock market.

You could argue that it's a problem that a vast majority of the nation have functionally no stake in the financial assets. I would agree with you on that point.  6/4/2013 11:41:49 AM 6/4/2013 11:41:49 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

^a related point being: why is the stock market so disconnected from "on the ground" conditions?

I understand why there are smaller, short-term differences all the time. In this case though, surely investors and companies realize the long-term damage to demand that the downward pressure on the middle class will most likely create. I realize that, atleast these days, company/shareholder decisions are governed by short-term gains, but how do you miss the potential end game?  6/4/2013 12:55:16 PM 6/4/2013 12:55:16 PM

|

Kris

All American

36908 Posts

user info

edit post |

| Quote : | | "I understand why there are smaller, short-term differences all the time. In this case though, surely investors and companies realize the long-term damage to demand that the downward pressure on the middle class will most likely create." |

I'd guess two causes, one is the lag between stock market investing and "real" investing, the other is government austerity measures. An example of the first is that I feel comfortable to start investing money, so I buy some company's stock, this helps them build a factory so they can employ more people and make more stuff. The upper class gets the push as soon as I invest my money, the lower class doesn't get it until the factory is built. 6/4/2013 1:09:49 PM 6/4/2013 1:09:49 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

^which makes perfect sense, but

Is there any growing demand right now that would require building additional factories? Perhaps there is in certain sectors but on the whole, as the vast majority of us are losing wealth, shouldnt we see demand fall? And yet we see investors dumping money into certain sectors as if they are set to grow at some point. The companies pay out dividends and drop the rest in savings accounts, and then their stock climbs even higher as if they actually did invest. The market just seems very disconnected from the actual economic fundamentals I'm looking at.  6/4/2013 1:30:07 PM 6/4/2013 1:30:07 PM

|

Kris

All American

36908 Posts

user info

edit post |

US consumer spending

6/4/2013 1:33:06 PM 6/4/2013 1:33:06 PM

|

mrfrog

☯

15145 Posts

user info

edit post |

| Quote : | | "I realize that, atleast these days, company/shareholder decisions are governed by short-term gains, but how do you miss the potential end game?" |

It's broader than that. Macroeconomics is all about the interdependent cycle of consumption and production. Because of that the laws change entirely once you change reference frames from the individual rational actor to the optimal policy throughout the entire economy. It's not the responsibility of the companies to worry about the broader balance. They're worried about competitiveness, and this concern is almost always at odds with the macroeconomics perspective.

I recently watched an amazing talk on this. If you want an hour of pure fast-paced demolishing of austerity, this is a good one.

http://www.youtube.com/watch?v=JQuHSQXxsjM

But I fear the principles are facing new challenges. We use the word "economy", but after globalization, is this something we have full authority over? Of course not. After all, it was globalization that prompted the formation of the disastrous monetary union which is the EU.

There are also a lot of subtle arguments in macro theories that are strange. For instance, we don't really need to increase consumption. On a household level, there are very few fixed obligations anymore like food. For the rich, spending is almost entirely discretionary, meaning that a poor appetite for consumption on their part is a simple and unqualified death sentence for the economy.

The market downside risk is the same mechanism as the inequality growth. Markets slowly march upward, but then plunge downward in a frenzied panic, since fear is plainly reinforcing. While I'm not personally concerned about technological unemployment, we have long since been beyond the point where a drought of consumption by the rich can stop the economy entirely as well as functionally decree that over half of society shall have no access to monetary means. Literally. This is not far from what's happening in the European periphery.

There is a massive growing problem of huge swaths of society with no means to participate in the economy. It's an obviously ridiculous proposition, and should make one question the structure of our corporate human infrastructure, as well as any remaining shreds of claims to a free market entrepreneurial economy. The Keynesian endgame looks most like mercantilism to me, and this is clearly where we're headed. If we all start to look like Greece because of the austerity screams of people like MisterGreen, then people will demand a central authority to mandate what "noble" consumption is, thus bringing us to full employment and what is probably a more natural state for human society. After such a change, claims to ownership in our economy become largely irrelevant since the only expense approved by the masses is building pyramids, a moon mission to beat the Soviets, forcing opium addiction on China so we can import tea, etc.

History is very familiar with these examples, and I'm starting to see the macro story as just that - the ebb and flow of empires. The decisions of the 2000s with the Bush presidency will clearly be formative in our next step, although I can't guess exactly what that'll be. Right now we're so deep in fiscal and political constraints that we won't get out until full financial manipulation of our debts and economy receives the people's stamp of approval, which it will.

[Edited on June 4, 2013 at 1:38 PM. Reason : ] 6/4/2013 1:36:07 PM 6/4/2013 1:36:07 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

| Quote : | | "US consumer spending " |

If you take a look at recent data, that spending growth started stagnating in April (sorry, no charts that up-to-date). Obviously it could turn around again and keep going up, well we can hope.

But if you step back, can you really hope for continued, strong, growth in consumer spending if wages continue to be flat or decrease? No, the best we can hope for is spending growth coupled with increased household debt. One can make some arguments that it isn't necessarily a bad thing, IMO it just starts building our economy on a much weaker foundation. 6/4/2013 3:19:51 PM 6/4/2013 3:19:51 PM

|

Kris

All American

36908 Posts

user info

edit post |

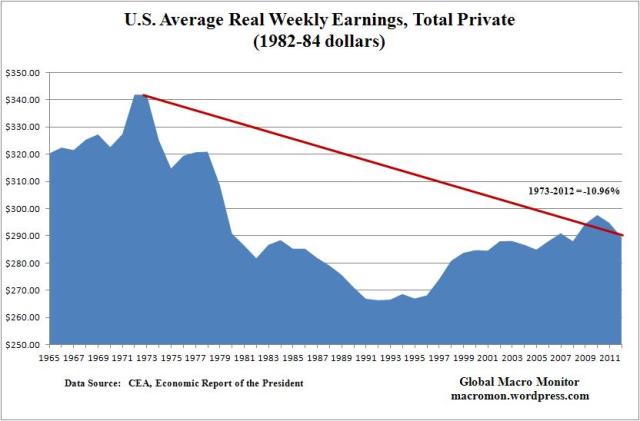

Wages have been going up:

I think the OP is throwing you off. It is talking about net worth, which doesn't have as much to do with wages as you might think. I think what is pulling down the net worth of the lower and middle class is a sluggish return in home prices, which is where most of those classes' net worth is tied.

[Edited on June 4, 2013 at 3:37 PM. Reason : ]  6/4/2013 3:36:51 PM 6/4/2013 3:36:51 PM

|

Pupils DiL8t

All American

4921 Posts

user info

edit post |

Would those numbers need to be adjusted for inflation or is the rate of inflation over that time period so insignificant that any adjustments would lack any relevance?  6/4/2013 4:26:59 PM 6/4/2013 4:26:59 PM

|

Kris

All American

36908 Posts

user info

edit post |

They are inflation adjusted, but within the small window I used it really wouldn't have mattered either way.  6/4/2013 5:17:33 PM 6/4/2013 5:17:33 PM

|

RedGuard

All American

5596 Posts

user info

edit post |

If housing is what's hosing lower and middle class households net worth, it'll be curious to see the numbers from 2012 and 2013 with the growing recovery of the housing market. If lower and middle income families net worths have gone up, it means that they've survived the housing collapse. However, if they remain stagnant, it may be that what net worth they had tied to housing has been foreclosed on and stripped away from them in the recession.

Honestly though, I'm still a bit pessimistic about lower to middle income net worths in the midterm. The fundamental restructuring of the economy which started back in the 1990s and accelerated in the last decade has created such tremendous productivity efficiencies that there's little incentive for companies to bring employment numbers back to pre-recession levels. Meanwhile, we don't have a new industry, like the great tech boom of the 1990s, that can reabsorb all that labor. I don't think green industries for example will be sufficient to absorb the sheer number of losses in other sectors, particularly traditional manufacturing.  6/4/2013 5:47:33 PM 6/4/2013 5:47:33 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

The graph of US wages shows we have had a slight increase since the darkest days of one of the worst recessions in our nations history . If you take a look at the graph and measure "post recession" growth (since late 2009) then you see almost none

ok, well, I suppose it could continue its trajectory. But again, if we back up and look at a larger dataset:

Real wages really haven't done anything for 40 years, and possibly have decreased. What makes you think we are gonna buck that trend?

[Edited on June 4, 2013 at 6:25 PM. Reason : .]  6/4/2013 6:22:22 PM 6/4/2013 6:22:22 PM

|

d357r0y3r

Jimmies: Unrustled

8198 Posts

user info

edit post |

Yeah, real wages really did bottom out. Back in the 50s, one paycheck bought a 50" Plasma TV, maybe two. These days? You're lucky to get out of there with a 42".  6/4/2013 7:26:33 PM 6/4/2013 7:26:33 PM

|

sarijoul

All American

14208 Posts

user info

edit post |

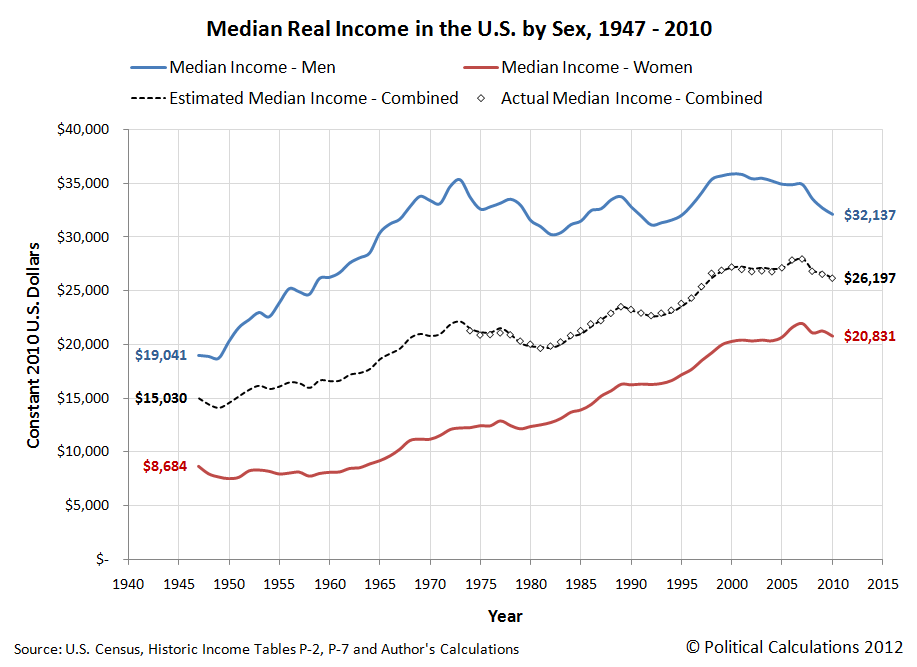

average earnings doesn't tell that much. median is where it's at.

6/4/2013 9:03:15 PM 6/4/2013 9:03:15 PM

|

IMStoned420

All American

15485 Posts

user info

edit post |

Yeah, I can't believe kris posted that average wages have gone up. No one is disputing that. But the average wage includes the top 7% of earners and throws the whole thing off.  6/4/2013 11:57:40 PM 6/4/2013 11:57:40 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

I think I posted averages, mostly because it was one of the better images I found in my quick google search. I think all the average does (vs the median) is capture more of the skew in the data toward low earners (since there are way more low wage earners). Since we are discussing a trend and not what the specific wage is I don't think it will make a huge difference. You can see in the median graph that wages still haven't grown much since sometime in the 70s.  6/5/2013 6:38:07 AM 6/5/2013 6:38:07 AM

|

smc

All American

9221 Posts

user info

edit post |

Of course trickle down is silly, anyone with a brain can see that. The bigger question is why the rich should even care how poor the masses are. As long as there isn't a revolution on the horizon, might as well kick them while they're down.  6/5/2013 8:04:23 AM 6/5/2013 8:04:23 AM

|

Pupils DiL8t

All American

4921 Posts

user info

edit post |

I enjoyed watching that. I wish the speaker had gone a little slower and that slides were shown a little longer, but it definitely made me want to check out some of his books.

He lost me a bit at one point when he said that he was going to take out a large mortgage; he said it was a win-win. If the market improves, so does the value of his home; however, I missed what he said would be the upside if the market sours. Can someone clarify that for me?

[Edited on June 5, 2013 at 4:44 PM. Reason : ] 6/5/2013 4:43:21 PM 6/5/2013 4:43:21 PM

|

sarijoul

All American

14208 Posts

user info

edit post |

| Quote : | | "I think all the average does (vs the median) is capture more of the skew in the data toward low earners (since there are way more low wage earners)." |

no. that's not how it works.

if you have 99 people who make $1/year and one guy who makes $901/year, the average is $10/year. That doesn't really tell us much. The median is a much closer approximation of what the average person is making. 6/5/2013 7:42:26 PM 6/5/2013 7:42:26 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

Ugh yeah I had it backwards, the mean catches more of the tail in skewed data (which in this case would be high earners)

But that actually strengthens the argument behind the graph I posted, the average would tend to bring wages up, as high earners income grew. Yet even with high incomes tugging the average wage up, they have still had stagnant growth since the 70s. That's the only point I'm trying to make here.  6/5/2013 8:17:26 PM 6/5/2013 8:17:26 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

http://economix.blogs.nytimes.com/2013/06/11/financialization-as-a-cause-of-economic-malaise/

| Quote : | "The rising share of income going to financial assets also contributes to labor’s falling share. As illustrated in the following chart from the Federal Reserve Bank of St. Louis, that share has fallen 12 percentage points since its recent peak in early 2001 and even more from its historical level from the 1950s through the 1970s.

...

The falling labor share results from various factors, including globalization, technology and institutional factors like declining unionization. But according to a new report from the International Labor Organization, a United Nations agency, financialization is by far the largest contributor in developed economies (see Page 52).

The report estimates that 46 percent of labor’s falling share resulted from financialization , 19 percent from globalization, 10 percent from technological change and 25 percent from institutional factors.

This phenomenon is a major cause of rising income inequality, which itself is an important reason for inadequate growth. As the entrepreneur Nick Hanauer pointed out at a Senate Banking, Housing and Urban Affairs Committee hearing on June 6, the income of the middle class is critical to economic growth because of its buying power. Mr. Hanauer believes consumption is really what drives growth; business people like him invest and create jobs to take advantage of middle-class demands for goods and services, which must be supported by good-paying jobs and rising incomes." |

6/11/2013 4:31:03 PM 6/11/2013 4:31:03 PM

|

Bullet

All American

27946 Posts

user info

edit post |

http://www.whydontyoutrythis.com/2013/05/world-s-100-richest-earned-enough-in-2012-to-end-global-poverty-4-times-over.html  6/11/2013 4:59:20 PM 6/11/2013 4:59:20 PM

|

Smath74

All American

93277 Posts

user info

edit post |

give a man a fish or teach a man to fish?  6/11/2013 7:12:22 PM 6/11/2013 7:12:22 PM

|

lewisje

All American

9196 Posts

user info

edit post |

^the rich would prefer neither, as they would threaten their dominance

Now on a less serious note, I just remembered that the first time I heard any reference to "trickle-down economics" was about 45:40 into Joe's Apartment (1996): http://www.solarmovie.so/link/play/1346094/

IMO the real thing makes about as much sense.  6/11/2013 8:53:19 PM 6/11/2013 8:53:19 PM

|

Kris

All American

36908 Posts

user info

edit post |

| Quote : | | "give a man a fish or teach a man to fish?" |

Knowing how to fish is worthless without a fishing line and a hook. 6/11/2013 9:26:49 PM 6/11/2013 9:26:49 PM

|

y0willy0

All American

7863 Posts

user info

edit post |

http://www.nationalreview.com/article/350983/ron-johnsons-transformative-proposal-jonathan-strong

I guess ill put this here since it will be discussed more thoroughly than if I put it in Obama's credibility thread.

I don't know if there is a Congress credibility thread?

Anyway, most of my more liberal friends always try to minimize these problems and say we have more important things to worry about right now. A certain amount of debt is healthy and it's silly for people like me to worry about it. Small potatoes? Doesn't look so small to me. Shouldn't people be concerned as long as such scenarios fall within their lifetime?

I really hate baby boomers for fucking us all in the name of their comfort.  6/13/2013 2:37:45 PM 6/13/2013 2:37:45 PM

|

HockeyRoman

All American

11811 Posts

user info

edit post |

| Quote : | | "give a man a fish or teach a man to fish?" |

Teach a man to fish and he'll strip mine the ocean and shrug saying it's capitalism... 6/13/2013 2:55:43 PM 6/13/2013 2:55:43 PM

|

ScubaSteve

All American

5523 Posts

user info

edit post |

Give a man 1 million fish and a big freezer...  6/13/2013 3:30:47 PM 6/13/2013 3:30:47 PM

|

FuhCtious

All American

11955 Posts

user info

edit post |

| Quote : | "He lost me a bit at one point when he said that he was going to take out a large mortgage; he said it was a win-win. If the market improves, so does the value of his home; however, I missed what he said would be the upside if the market sours. Can someone clarify that for me?

" |

Basically inflation goes up so that he doesn't have to pay them as much as he actually owes. When inflation goes up, his actual debt amount will stay constant, but he will have more dollars to pay it back. 6/14/2013 1:10:54 PM 6/14/2013 1:10:54 PM

|

jcgolden

Suspended

1394 Posts

user info

edit post |

at this stage in human progress: everyone on the planet should have food, water, multivitamins, safety, anomalous/catastrophic healthcares, and high quality education (via internet). proll freedom to move about the planet and persuit of happiness too.

ppl don't yet have: use of excessive resources even when it's artificially cheap, access to all luxuries.

hurry up star trek future  6/15/2013 1:20:42 PM 6/15/2013 1:20:42 PM

|