CarZin

patent pending

10527 Posts

user info

edit post |

Delta is beginning to suck hardcore. We've been loyal Delta. Every now and then we will get medallion when the stars align. But they have sucked away so much from their customers, and their skymiles redemption is expensive. AA seems to have the best redemption levels, but I hate AA even more than Delta (old crappy planes). I've had no problems with United.  10/9/2014 1:49:38 PM 10/9/2014 1:49:38 PM

|

neodata686

All American

11577 Posts

user info

edit post |

I haven't had any issues with United. My biggest problem is there's no wifi. Why I still prefer Delta for work if it's a short flight. I lose a few hours of email flying United. Sucks.  10/9/2014 1:55:33 PM 10/9/2014 1:55:33 PM

|

CarZin

patent pending

10527 Posts

user info

edit post |

Yeah, I think Delta still has the most updated fleet with all the extras. Unfortunately they know it.  10/9/2014 2:04:50 PM 10/9/2014 2:04:50 PM

|

neodata686

All American

11577 Posts

user info

edit post |

My buddy works for United. He said they're working on the wifi issue. Flew Air Canada this week (through United) and they enforce no headphones during taxi, takeoff, and landing. Kind of annoying.  10/9/2014 2:07:06 PM 10/9/2014 2:07:06 PM

|

Jrb599

All American

8845 Posts

user info

edit post |

^^I flew into ATL on the crappiest plane ever (Delta). Then flew out on the nicest plan. Seems to have quite a bit of variance - at least in my experience.  10/9/2014 2:23:23 PM 10/9/2014 2:23:23 PM

|

David0603

All American

12760 Posts

user info

edit post |

Flew Lufthansa, for the first time last month. That was one nice flight!  10/9/2014 2:56:32 PM 10/9/2014 2:56:32 PM

|

Jrb599

All American

8845 Posts

user info

edit post |

Anyone have luck selling United Miles? Having a hard time getting Bruce to respond.  10/9/2014 3:46:00 PM 10/9/2014 3:46:00 PM

|

David0603

All American

12760 Posts

user info

edit post |

Yes.  10/9/2014 6:44:25 PM 10/9/2014 6:44:25 PM

|

Jrb599

All American

8845 Posts

user info

edit post |

where/when  10/10/2014 6:53:03 AM 10/10/2014 6:53:03 AM

|

synapse

play so hard

60908 Posts

user info

edit post |

brucergoldberg@gmail.com

brucergoldberg2@gmail.com  10/10/2014 9:42:07 AM 10/10/2014 9:42:07 AM

|

David0603

All American

12760 Posts

user info

edit post |

^ Like two years ago.  10/10/2014 10:54:41 AM 10/10/2014 10:54:41 AM

|

Jrb599

All American

8845 Posts

user info

edit post |

I was talking about more recent as mile values tend to change  10/10/2014 12:20:49 PM 10/10/2014 12:20:49 PM

|

pttyndal

WINGS!!!!!

35217 Posts

user info

edit post |

Got an email from him on the 4th looking for airline miles and Chase and Amex points so he's still alive.  10/10/2014 2:28:09 PM 10/10/2014 2:28:09 PM

|

David0603

All American

12760 Posts

user info

edit post |

Ditto  10/10/2014 2:29:41 PM 10/10/2014 2:29:41 PM

|

slappy1

All American

2303 Posts

user info

edit post |

okay so I found a script I was going to use (http://millionmilesecrets.com/2012/12/05/chase-business-reconsideration/) and finally got up the nerve to call the recon line.

It turns out I was already approved and the card is in the mail to me

where is my email telling me so? grr. all that nervousness for nothing  10/10/2014 2:43:51 PM 10/10/2014 2:43:51 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

Yeah usually I either get a card or an denial instructing me to call the reconsideration line, via postal mail.

[Edited on October 10, 2014 at 2:57 PM. Reason : ^^^ +1]  10/10/2014 2:56:42 PM 10/10/2014 2:56:42 PM

|

slappy1

All American

2303 Posts

user info

edit post |

the only other card I didn't receive instant approval for (my recent Amex Bus card) I received email confirmation a few days later sayign I was approved

Also - they gave me a $15k credit line, and I surely don't need that much. That means I'll have about 30k with Chase...is that a good or bad thing for my credit? I'm tempted to shut down my Sapphire preferred card before the fee hits...it makes me nervous having all these open CC's. I don't carry any balances.

[Edited on October 10, 2014 at 3:16 PM. Reason : lll]  10/10/2014 3:14:44 PM 10/10/2014 3:14:44 PM

|

David0603

All American

12760 Posts

user info

edit post |

Good  10/10/2014 3:26:33 PM 10/10/2014 3:26:33 PM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

Open Credit is Good,makes your overall utilization rate look better.  10/10/2014 3:30:48 PM 10/10/2014 3:30:48 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

Good thing.

Worst thing to happen is down the road at some point you might max out your credit ceiling with Chase, you'll get declined, then you call in for reconsideration and offer to move some credit limit from one older card ($5k of $15k eg) to open up the newer card.  10/10/2014 4:19:43 PM 10/10/2014 4:19:43 PM

|

David0603

All American

12760 Posts

user info

edit post |

Eugh, got hit with what I assume is a cash advance fee for my US Bank card via Serve.

10/10/2014 Cash Equivalent Fee $10.00

10/10/2014 American Express Serve $200.00  10/12/2014 8:49:39 PM 10/12/2014 8:49:39 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

ouch  10/12/2014 9:10:38 PM 10/12/2014 9:10:38 PM

|

David0603

All American

12760 Posts

user info

edit post |

Yeah, crappy timing

http://frequentmiler.boardingarea.com/2014/10/11/serve-no-longer-safe-with-us-bank/  10/12/2014 9:28:05 PM 10/12/2014 9:28:05 PM

|

slappy1

All American

2303 Posts

user info

edit post |

got my Ink Plus on Monday, hit the 5k spend yesterday (thanks to a big purchase at work)

I wonder if I should close my Sapphire card soon (annual fee hits in a few weeks)...I don't see a point in keeping it open (since the UR rewards points from that will be carried over to the Ink account, right?). Am I missing something?  10/21/2014 12:36:30 PM 10/21/2014 12:36:30 PM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

The insurance on the sapphire is awesome, but if you are going to use the INK from now on I think you get the same benefits.

I got a free desktop computer because the one I had only had a 90 day warranty and the motherboard went bad. They double your mfr warranty on purchased items.  10/21/2014 1:13:22 PM 10/21/2014 1:13:22 PM

|

pttyndal

WINGS!!!!!

35217 Posts

user info

edit post |

yeah, think pretty much every card has those standard Visa/Mastercard benefits. Only real benefit of the CSP is the 7% annual bonus (being phased out at the end of 2015) and the extra 1% on dining depending on how much you eat out. You can probably call and and get them to give you enough points to cover the annual fee or at least reduce it which is what I did the first year. Ink Plus still allows you to use Ultimate Rewards so just be sure to transfer your points to the ink card before cancelling.  10/21/2014 1:20:36 PM 10/21/2014 1:20:36 PM

|

slappy1

All American

2303 Posts

user info

edit post |

I think this may have already been asked/answered in here, but that 7% bonus only applies to points earned via spend, right? (Like, I'm not going to be getting 7% on the initial 60 or 70k pts I got from the sign-up bonus)

If so, I don't think I use the card enough organically for that 7% bonus to mean much  10/21/2014 3:22:31 PM 10/21/2014 3:22:31 PM

|

AntecK7

All American

7755 Posts

user info

edit post |

how is the visa black card? Fees seem a little high, not sure if its just some fancy card or the benefits are actually solid.

seems to not have great reveiws.

https://www.creditkarma.com/reviews/credit-card/single/id/CCBarclays1240  10/27/2014 11:33:09 PM 10/27/2014 11:33:09 PM

|

David0603

All American

12760 Posts

user info

edit post |

weak

Stainless Steel Card – Patent Pending

An Industry-Leading Rewards Program

Exclusive 24-Hour Concierge Service

VIP Treatment at over 3,000 Properties

Unlimited VIP Airport Lounge Visits

Members Only – Black Card Magazine

Luxury Gifts from the World’s Top Brand  10/28/2014 11:24:03 AM 10/28/2014 11:24:03 AM

|

CarZin

patent pending

10527 Posts

user info

edit post |

Antek: the black card sucks. If you are going to pay that amount, go ahead and get Amex Platinum with a far better benefits package.

We've had the Platinum for 2 years. I carry it for Lounge access, Fine Hotels, and some of the insurance travel protections it has. You also get $200 in incidental reimbursement, so the cost really is $475-200=$275. My wife and I both got our Global Entry fees reimbursed (around $100 a piece). But you have to travel a decent amount of justify it, and travel 'well'. Or you just have an expensive card with no benefits.

[Edited on October 28, 2014 at 1:29 PM. Reason : .]  10/28/2014 1:22:34 PM 10/28/2014 1:22:34 PM

|

David0603

All American

12760 Posts

user info

edit post |

Finally signed up for award wallet and it was nice enough to remind me my marriott free night expires in 3 weeks.  10/28/2014 4:50:44 PM 10/28/2014 4:50:44 PM

|

neodata686

All American

11577 Posts

user info

edit post |

Probably going to waste my free Marriott night. There's literally no where with a cat 5 Marriott.     10/28/2014 6:34:41 PM 10/28/2014 6:34:41 PM

|

rflong

All American

11472 Posts

user info

edit post |

I'm thinking about signing up for the AMEX Blue Card. $250 statement credit after $1000 in spending, 3% at supermarkets, 2% gas, 2% select stores, and 1% everything else. Being able to earn statement credits (i.e. cash) is appealing to me. Plus no annual fee. What are your thoughts? Right now I only carry some shit Citi card that gets 1% back in thank you points.  10/29/2014 5:13:36 PM 10/29/2014 5:13:36 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

https://www.penfed.org/visasignaturepoints/

4% back on gas and 2.4% back on supermarkets. I think they'll cut you a check but I'm not positive.  10/29/2014 5:21:12 PM 10/29/2014 5:21:12 PM

|

Chief

All American

3402 Posts

user info

edit post |

Where do you see those percentages in that link? Only see 5pts and 3pts respectively. Need a card for groceries.  10/29/2014 8:34:45 PM 10/29/2014 8:34:45 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

5 points...and points are worth .85 cents each or something along those lines. Just got a $250 Visa Gift Card from them

[Edited on October 29, 2014 at 8:39 PM. Reason : Blue Cash card does 6% on groceries, but you gotta pay an annual fee]

[Edited on October 29, 2014 at 8:39 PM. Reason : http://www.cardhub.com/best-gas-credit-cards/]  10/29/2014 8:38:38 PM 10/29/2014 8:38:38 PM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

Marriott Card is about to get axed. Not paying annual fee next year to never use it, even with free night like someone said above Cat 5 is like the fucking fairfield now, I can just pay the hundred bucks at that time....  10/30/2014 1:09:02 AM 10/30/2014 1:09:02 AM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

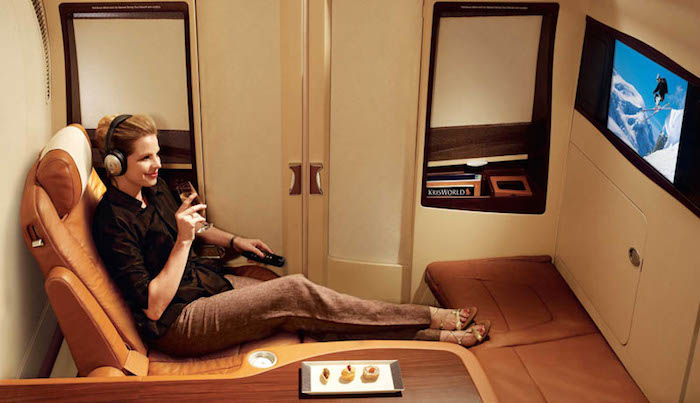

Also this is the most epic airline miles cash in ever...

https://medium.com/travel-adventure/what-its-like-to-fly-the-23-000-singapore-airlines-suites-class-17d9f3fee0d

10/30/2014 1:12:02 AM 10/30/2014 1:12:02 AM

|

aimorris

All American

15213 Posts

user info

edit post |

awesome  10/30/2014 8:39:48 AM 10/30/2014 8:39:48 AM

|

synapse

play so hard

60908 Posts

user info

edit post |

http://www.businessinsider.com/the-5-best-credit-cards-for-the-wealthy-2013-7?op=1  10/30/2014 2:06:46 PM 10/30/2014 2:06:46 PM

|

David0603

All American

12760 Posts

user info

edit post |

Almost time for another churn, thinking citi 2 free night card and lufthansa but not sure what else.  10/30/2014 2:22:27 PM 10/30/2014 2:22:27 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

Which Lufthansa card?  10/30/2014 2:35:10 PM 10/30/2014 2:35:10 PM

|

David0603

All American

12760 Posts

user info

edit post |

Barclay  10/30/2014 2:48:18 PM 10/30/2014 2:48:18 PM

|

NCSUMEB

All American

2530 Posts

user info

edit post |

^^^, Citi's are a pain to churn, methods?? From some others I think Brit Air by Chase is going to up their typical 50K Avios sign up shortly around holidays.  10/30/2014 3:46:35 PM 10/30/2014 3:46:35 PM

|

Førte

All American

23525 Posts

user info

edit post |

got an offer in the mail for the AMEX Blue Cash card; almost threw it in the trash, but opened it hoping for a special offer. it was. $250 back after spending $1000 in 3 months. signed up and instantly approved with a $15,000 CL. woo free money.  10/30/2014 3:46:39 PM 10/30/2014 3:46:39 PM

|

pttyndal

WINGS!!!!!

35217 Posts

user info

edit post |

yay fraud alert on my Sapphire Preferred. Got an email about a $250 charge online to ThinkGeek. Didn't have the expiration date, code on the back or billing address correct so they're just thinking they were guessing numbers.  10/30/2014 3:54:52 PM 10/30/2014 3:54:52 PM

|

David0603

All American

12760 Posts

user info

edit post |

| Quote : | | "Citi's are a pain to churn, methods??" |

wat 10/30/2014 4:38:21 PM 10/30/2014 4:38:21 PM

|

slappy1

All American

2303 Posts

user info

edit post |

I keep getting emails from chase about how they're extending my credit limits, which I didn't ask for and I don't want. I'm getting nervous that I need to start closing some of my cards. HALP  10/31/2014 1:50:22 AM 10/31/2014 1:50:22 AM

|

quagmire02

All American

44225 Posts

user info

edit post |

| Quote : | | "I keep getting emails from chase about how they're extending my credit limits, which I didn't ask for and I don't want." |

why do you care if they increase your limit? doesn't that just mean that you'll have a lower debt-to-credit ratio? it's not like you have to use it 10/31/2014 7:51:15 AM 10/31/2014 7:51:15 AM

|

NCSUMEB

All American

2530 Posts

user info

edit post |

^^^, I got criss crossed between thinking I was on FT but was on TWW.  10/31/2014 9:13:59 AM 10/31/2014 9:13:59 AM

|