TerdFerguson

All American

6570 Posts

user info

edit post |

What do you guys think? Was it time to stop QE, are we already too late, or is another round IMMINENT.....

Post your predictions, make them convincing!  10/29/2014 6:00:28 PM 10/29/2014 6:00:28 PM

|

CuntPunter

Veteran

429 Posts

user info

edit post |

It's been time. The sad thing is, the Fed thinks it did something when the market would have worked just fine. The next recession will be come in a few years not long after the banks finally actually start lending again and we repeat the mistakes of 2002-2007  10/29/2014 6:14:55 PM 10/29/2014 6:14:55 PM

|

wlb420

All American

9053 Posts

user info

edit post |

bond. liquidity. crisis.

student. loan. bubble.

rinse. and. repeat.  10/29/2014 6:30:53 PM 10/29/2014 6:30:53 PM

|

theDuke866

All American

52653 Posts

user info

edit post |

They will continue with reduced QE for a little longer.

[Edited on October 29, 2014 at 6:35 PM. Reason : ]  10/29/2014 6:35:24 PM 10/29/2014 6:35:24 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

^i thought they had been dwindling down and made the announcement that QE was ending this month?

I think we are still facing some pretty heavy headwinds that haven't fully developed yet, and QE4 is imminent, probably within the next year (eternal pessimist here).

The factors:

-slow downs from all across the globe. Still a decent chance Europe implodes, China and some emerging markets have shown some slow down as well. US has done well in spite of these, but eventually their lack of demand will create a pretty heavy drag on us.

-this is partly due to exports being such an important part of our current growth. With those countries slowing and with the strengthening dollar, demand will fall

-potential for volatile oil/fuel prices? With ISIS possibly disrupting things, or even OPEC deciding it needs higher prices and some expectations for a cold winter, vast swings in prices could harm growth

-bad season for retail/Xmas/holidays? With wages still flat theirs a chance of a poor Xmas retail season and will spook the shit out if investors

-republicans win mid-terms? They either play more budget/shutdown games, or are actually successful in reducing federal spending, either way the economy suffers

The one thing that might stop QE4 is the acknowledgement by the FED that all of the QE rounds have been a mostly ineffective waste of time. So perhaps they will advocate for direct stimulus this time? Lol yea right.  10/30/2014 1:00:37 PM 10/30/2014 1:00:37 PM

|

Pupils DiL8t

All American

4904 Posts

user info

edit post |

Can we also include predictions for when interest rates will increase?

The last prediction that I read suggested an increase between March and May of next year, but I believe Europe's economy has performed worse since I read that prediction.  10/30/2014 1:40:24 PM 10/30/2014 1:40:24 PM

|

Smath74

All American

93277 Posts

user info

edit post |

I'm asking this as an honest question to better understand quantitative easing... this is essentially the government printing more money? Where does that money go? how is it distributed? (if i'm wrong, i humbly ask to be educated)  10/30/2014 3:44:01 PM 10/30/2014 3:44:01 PM

|

mrfrog

☯

15145 Posts

user info

edit post |

^ The Fed buys financial assets. My understanding is that this plays a role in increasing the money supply of some sort, although not necessarily putting out more currency. As I'm sure you know, banks have requirements of debt to assets and such, but when things go south they seek to reduce that. This sucks liquidity out of the markets. The Fed just counterbalances that by increasing both its "debt" and assets. But I put "debt" in quotation marks because the Fed can both issue money and is a lender of last resort. So basically rules don't apply to them. They are basically using their extraordinary power to keep liquidity flowing as if the world is about to end.  10/30/2014 3:57:46 PM 10/30/2014 3:57:46 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

http://www.bloomberg.com/news/2014-11-17/draghi-seen-bypassing-qe-qualms-to-hit-balance-sheet-goal.html

ECB bought to crank up that QE!!!!!

Good for them, possibly too little too late though? I'm still sorting out if I think QE is even that much of a stimulus, most people seem to be indicating it had a pretty minor effect.

| Quote : | "Can we also include predictions for when interest rates will increase?

" |

absolutely, folks can include all central banking discussions in here. I don't see an interest rate increase happening for a while (again eternal pessimist here). Not until we sustain at least 2% growth for several quarters IMO, and I just don't see us jumping off and reaching that. The overall problem with this low growth is the same and will be for some time: Lack of Demand.

Does anyone want to help me out with some Japan discussion? I haven't really been following it too closely and was hoping for some clif notes. 11/18/2014 9:09:37 AM 11/18/2014 9:09:37 AM

|

CuntPunter

Veteran

429 Posts

user info

edit post |

It echos the European discussion, aging population, coupled with high taxes and (relative) lack of new investment equals stagnant growth. The likes of Krugman continue for decades to beat the drum that if we just trick the people into thinking their assets will be worth less due to inflation that the economy will magically act as if it will be so.

[Edited on November 18, 2014 at 11:40 AM. Reason : .]  11/18/2014 11:39:01 AM 11/18/2014 11:39:01 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

People's Bank of China cutting interest rates due to China's slight slowdown:

http://www.reuters.com/article/2014/11/21/us-china-economy-rates-idUSKCN0J511020141121

A rundown on my headwind prediction:

-Europe and Japan still teetering on the edge of another recession, being very proactive. China and other emerging markets also showing some slowdown, but being proactive. I'm actually slightly more optimistic about this than I was during the above post.

-Oil prices seem like they could stay low for a while, thats what most of the analysis I've seen look like. ISIS seems to be a non issue in this area.

-Most holiday retail predictions I've seen were actually pretty rosy too. I mean, they pretty much always are so I guess I'm in wait and see mode on this.

-republicans won mid-terms, lots of conflicting views on budget and shutdown games. I'm more optimistic here though, there is a growing contingent, even among the uber-conservative, that shutdowns aren't really winning them any wars.

Overall I'm more optimistic. Maybe QE4 is not so imminent after all?

[Edited on November 21, 2014 at 1:04 PM. Reason : maybe I'm so optimistic because Markets are $$$$$ today, enjoying the bump I guess]  11/21/2014 12:54:15 PM 11/21/2014 12:54:15 PM

|

CuntPunter

Veteran

429 Posts

user info

edit post |

What blows my mind is the GDP growth in Europe has been worse for the Great Recession than the Great Depression...and yet you don't see the mass poverty, food lines, and other indicators of "a really shitty situation". Could it be this obsession with GDP is misplaced as the be-all-end-all indicator of societal health? Are we just measuring it way wrong and things, while clearly not roses, are vastly better than the number would seem to indicate?

[Edited on November 22, 2014 at 12:35 PM. Reason : .]  11/22/2014 12:34:10 PM 11/22/2014 12:34:10 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

Very, excellent point my muff booting friend,

No sane person could disagree with you. GDP is an extremely blunt measurement of an economy's overall health. Still, I think it has a few things working for it, namely how easy/simple and uncontroversial it is to measure (important consideration for central banks), and its direct connection to money movement through an economy, and the endless debatable factors that can affect that (money supply, money velocity, consumer expectations, etc).

Still there are a lot of things that should also be closely considered in tandem when looking at the health of an economy, namely I'm thinking inequality and the welfare state. With the welfare state that developed after the Great Depression (esp in Europe) being responsible for us not seeing the mass DIRE POVERTY that we saw during the Great Recession.

The obvious caveats being that there is still room for Europe to plunge into even a deeper Great Recession in the relatively near future where we would see the mass "shitty situations" start to appear. The other caveat being that the European welfare state is partly responsible for their current troubles. An argument I think is an extreme over simplification, but recognize it does have some merits. There is a huge amount of nuance and debate between where the balance point between welfare and free markets occurs (an endless array of factors that explain the differences between the current EU and some scandinavian (and others) that are still killing it despite everything.)

What I really and truly find endlessly interesting is some of the developing realms of economics that recognize that GDP, and especially GDP growth, is basically useless. I see them refer to themselves as no-growth or post-growth economics. I'm no expert, there may be other areas that recognize the limits of GDP and seek other measurements for health/happiness/"wealth." However, the decoupling of "wealth" to GDP growth is a recurring theme of cutting edge economics, that IMO cannot grow fast enough.

Europe has always been slightly ahead of us economically. When we were still kinda 3rd world status 175 years ago they were basically 1st world. Years later, while we still struggle with a basic welfare state, they, for the most part, have had one established for years. One wonders if they are leading the way again into a post-growth (GDP wise) system.  11/23/2014 8:42:49 PM 11/23/2014 8:42:49 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

Going back to my prediction, it looks like OPEC isn't cutting production anytime in the near future, meaning fuel prices should stay low for a while? That should be good for the US economy overall, with one small wrinkle that I'd not seen: several articles speculating that OPEC is trying to push prices lower to bankrupt the US shale gas/oil industry ( which was suffering at prices much higher than they are currently). Thats an 80-100 billion dollar industry (maybe more) and if it craters, it will be interesting to start weighing the pros and cons between a sinking American energy industry and dirt cheap fuel.

But to stay with the optimism theme, last quarters growth numbers were revised slightly upwards. We've had fairly reasonable growth for what, 5-6 quarters??? Makes me think that Pupils DiL8t 's prediction of an interest rate increase could come sooner than I'd thought (making almost all of my previous posts ITT absolutely wrong lol).  11/27/2014 11:57:21 PM 11/27/2014 11:57:21 PM

|

skokiaan

All American

26447 Posts

user info

edit post |

Stock market is at an all time high. It's already happening  11/28/2014 3:35:39 PM 11/28/2014 3:35:39 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

"It" being QE4 or an interest rate hike?  11/29/2014 9:33:02 AM 11/29/2014 9:33:02 AM

|

Pupils DiL8t

All American

4904 Posts

user info

edit post |

http://www.bloomberg.com/news/articles/2015-03-06/employment-report-bolsters-case-for-fed-rate-increase-in-june  3/6/2015 6:15:33 PM 3/6/2015 6:15:33 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

I still say that it's way too soon for a significant increase, Europe, oil prices, and a lack of wage increases are still a concern IMO. I guess I'd be ok with a minor increase, but that's about it.  3/6/2015 6:38:03 PM 3/6/2015 6:38:03 PM

|

CuntPunter

Veteran

429 Posts

user info

edit post |

Your comment doesn't make a ton of sense. They won't ever do a significant increase. If we ever get to that point they've failed (again) to do their job.  3/7/2015 10:59:24 AM 3/7/2015 10:59:24 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

Guy I work with thinks the rate should be 2% by the end of 2015 or early 2016, and I was all

That to me would be a significant increase. I was thinking more like 1% MAX (prob less) by the end of 2016.  3/7/2015 12:43:14 PM 3/7/2015 12:43:14 PM

|

CuntPunter

Veteran

429 Posts

user info

edit post |

They'll do what Greenspan did. They'll move slowly, notice that they aren't moving fast enough after an increase or two, and then by the time they try to pick the pace up it will be too late and they'll overshoot on the increases and kick us back into recession. The next go round will be student loan debt and energy producers starting the crash. Give it 3-4 years?  3/7/2015 6:36:17 PM 3/7/2015 6:36:17 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

Excellent prediction, thank you for contributing

Here is mine:

The FED is under tremendous pressure to raise rates right now, and they will. Its just a question of to what degree, I fully think they'll fold to the pressures of the financial class and attempt to "get out in front of the (nonexistent) inflation" and raise rates rather quickly. This will prove catastrophic.

The result? Another recession. Europe will implode, and drag the world down with it. Oil Prices/developing economy cuts in interest rates will prove to be an indicator of an overall slowdown in the global economy, which will drag down the US, or alternatively wages in the US will prove unable to grow significantly, leading to a short to medium-term sputtering of the US growth rate.

As Larry Summers has written lately: An airplane with too much throttle might take off too quickly and cause some discomfort to the passengers. An airplane with not enough throttle will crash off the end of the runway and likely ignite and kill everyone. We need to factor in the relative risk of each scenario when making our decision on how to move forward. Some discomfort is worth risking crashing and burning IMO.

If we don't give the economy some throttle as we fly into the global headwinds, I think we will crash and burn, by early 2016.

The FED should be in a "wait and see mode." Slightly raising rates to deflate wall street in the near term, but being extremely hesitant to drop a huge rate increase that might cause us to nose dive.  3/7/2015 9:27:44 PM 3/7/2015 9:27:44 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

Greece and the ECB having a spot of tea:

Time to

6/29/2015 8:42:16 AM 6/29/2015 8:42:16 AM

|

Pupils DiL8t

All American

4904 Posts

user info

edit post |

http://www.marketwatch.com/story/jobs-report-looks-to-have-met-fed-criteria-for-rate-hike-in-september-2015-08-07

| Quote : | "The futures market is now pricing in up to a 75% probability that the Fed will raise interest rates at the September meeting, according to Steven Englander, global head of G-10 FX strategy at Citigroup...

James Glassman, economist at J.P. Morgan Chase JPM, -0.29% said it would take very poor economic data at this point to get the Fed to delay a rate hike at their September meeting." |

[Edited on August 7, 2015 at 5:22 PM. Reason : ] 8/7/2015 5:21:50 PM 8/7/2015 5:21:50 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

with all the global headwinds (and the ones at home) I never would've guessed the U.S. Economy could plod along, with OK but not great stats. It's surprising, and kinda impressive. I'm becoming more comfortable with a rate hike here at the end of the year.  8/8/2015 10:12:31 AM 8/8/2015 10:12:31 AM

|

skokiaan

All American

26447 Posts

user info

edit post |

disaster is coming eventually!  8/11/2015 3:04:01 AM 8/11/2015 3:04:01 AM

|

Pupils DiL8t

All American

4904 Posts

user info

edit post |

Any thoughts on whether the recent stock market tumble will affect the Fed's decision to raise interest rates?  8/23/2015 2:38:00 PM 8/23/2015 2:38:00 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

^ It'll be a Fed calculation of weighing domestic economic performance vs. international economic headwinds. I think in the end they'll wait another 3 months.  8/23/2015 4:06:18 PM 8/23/2015 4:06:18 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

i agree, I think they'll wait, unless there is a relatively strong jobs report.  8/23/2015 7:03:53 PM 8/23/2015 7:03:53 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

http://ftalphaville.ft.com/2015/08/28/2138606/some-fed-thoughts-qe4-and-all-that/?

| Quote : | "Some Fed thoughts: QE4 and all that

After a considerable period of boredom, trying to figure out America’s central bank has gotten interesting again.

...Tim Duy: "Critics will loudly proclaim that the Fed must hike in September if only to prove they are not governed by the equity markets. That call will be heard in the next FOMC meeting as well, but it will be a minority view. A thousand point drop in the Dow will not be ignored by the majority of the FOMC. Dismissing what are obviously fragile financial market conditions would be a hawkish signal the FOMC does not want to send. Hiking rates is not going to send a calming message of confidence. That never works. If the history of financial crises has taught us anything, it is that failure to respond with easier policy only adds to the turmoil."

The irony here is that this is the first time since 2008 when the disconnect between the financial markets and the real economy is working against the owners of risky assets. Until now, the owners of capital had been capturing most of the gains of the recovery whilst the people hardest hit by the downturn benefited the least. (That’s what happens when monetary policy tries to compensate for excessively tight fiscal policy.)

Which brings us to Ray Dalio’s latest missive on LinkedIn. His basic argument is that the rich countries haven’t yet made enough progress in cutting their debt loads, and until they do, monetary policy won’t work the same way it has in the past. That leads him to predict that short-term interest rates won’t rise very much before the next recession and easing cycle, at which point the Fed will once again find itself engaging in large-scale asset purchases to boost growth.

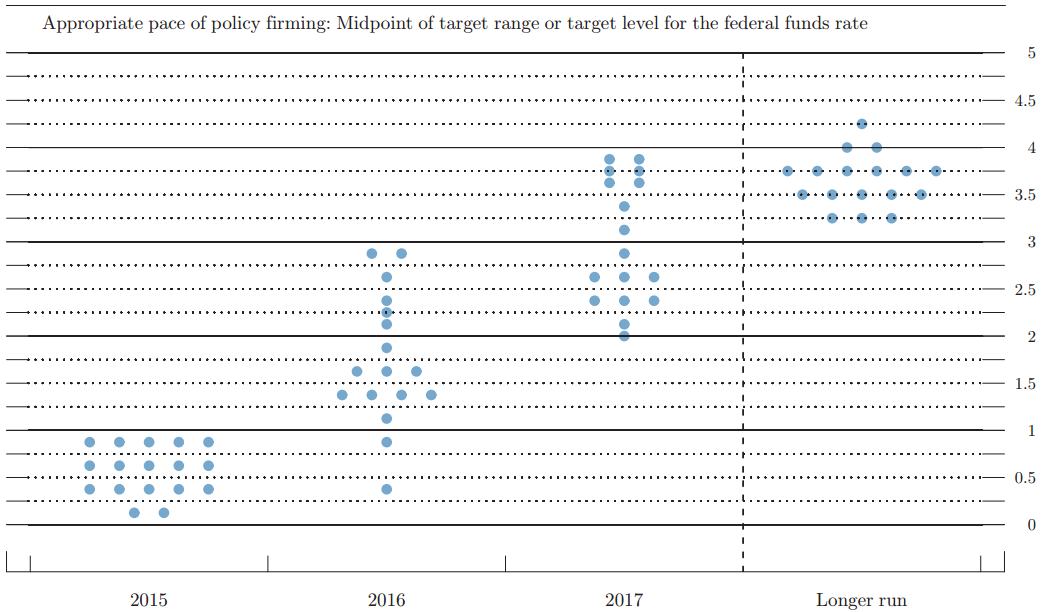

Some people with reading comprehension problems took this as a call to initiate “QE4?, but Dalio’s actual position doesn’t strike us as obviously unreasonable. According to the most recent FOMC Summary of Economic Projections (from June 17), policymakers expect nominal short-term interest rates to top out around 4 per cent:

Assume rates actually rise that far. A tightening cycle of around 4 percentage points would be a bit below the post-WWII average, although it would exactly match the average since Volcker’s disinflation. It’s also possible that the path implied by the dots would have short-term interest rates peaking somewhere above 4 per cent in 2018 or 2019 before the next recessions leads to cuts. Dalio is simply saying that the dynamics affecting the transmission of monetary policy to the real economy are different now than in 1985-2006, which leads him to think that the future path of short-term interest rates will be shallower than the dots in the chart above.

This view isn’t necessarily that different from what’s implied by market prices. For example, the current 1-year rate is around 36 basis points and the current 2-year rate is around 67 basis points, so the implied 1-year interest rate one year from now is a little less than 1 per cent — significantly below the midpoint of the Fed’s dots for 2016. Since the 3-year yield is only 98 basis points, that means the implied one-year rate for 2017 is just 1.6 per cent — lower than the lowest dot.

Even if you take the dots as gospel, it’s pretty easy to justify the current yield on the 10-year note (a little more than 2 per cent) by imagining a world where 1-year rates top out around 5 per cent by 2019, stay there until 2020, and then plunge back toward zero by 2022." |

8/28/2015 10:47:20 AM 8/28/2015 10:47:20 AM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

| Quote : | "(cut)

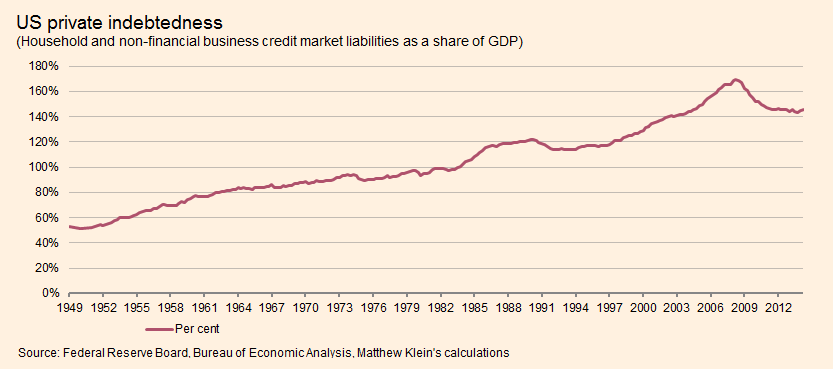

The disagreement between the Fed and Dalio (and the money-weighted-average opinion of traders) may not be as big as some are making it out to be, but the disagreement is real. It can boiled down to how you interpret the following chart, which shows the total stock of debt owed by the private non-financial sector divided by national income:

In the 1950s and 1960s, Americans gradually reacquired their appetite for borrowing after the Great Depression. But that only occurred after the great reflation of the 1940s had pushed down the private debt to GDP ratio by about 100 percentage points from its 1929 level. (That in turn can be attributed to the potent combination of massive fiscal deficits and interest rate caps imposed by the Fed.) Things more or less leveled off by the 1970s.

What’s interesting is when you get to the 1980s. Interest rates plunged after Volcker’s disinflation, which made it easier for people to borrow more against the same income. There was a lot of debate at the time about whether the big increase in private debt, much of it used to fund buyouts, M&A, and real estate investment would lead to a crisis and possibly a repeat of the dynamics of the 1930s. (Sound familiar?) It’s worth reading the papers and discussions from the 1986 Jackson Hole Economic Symposium — titled “Debt, Financial Stability, and Public Policy” — to get a flavour for how those arguments went.

As it turned out, both sides were partly right.

The downturn of the late 1980s and early 1990s was worst in areas that had experienced big housing bubbles earlier on, particularly southern California and New England. It also coincided with an enormous wave of bank failures unlike anything since the Depression. America’s first “jobless recovery” followed, and the discontent led to the most successful showing of a third-party presidential candidate in eighty years. The Fed, continually surprised at the economy’s persistent weakness, which it and other economists eventually attributed to a “credit crunch” caused by weak banks and excess private debt, ended up (grudgingly) cutting short-term interest rates by 7 percentage points.

Yet the economy did recover, the credit crunch ended, and the second half of the 1990s were boom years. Moreover, debt levels never really fell, and by 1998 they were breaching new highs relative to national income. Predictions of either depression or faster inflation (which would have helped reduce debt, in theory) both proved to be wrong. Arguably the secret ingredient was the equity bubble, which provided cheap financing for corporates to go on an investment binge while also encouraging households to save less and consume more.

When that burst, and business investment collapsed along with it, there were essentially three ways for the economy to grow: an improvement in net exports, fiscal stimulus, and higher household spending. Option 1 was effectively off the table because of the mercantilism of some of America’s biggest trade partners. Option 2 was tried, to a degree, but was discouraged even by people who now know better. That left the third option. But household savings rates were already lower than ever, while the average American’s net worth had just gotten thwacked by the collapse in stocks.

What happened next should be familiar. [FR: The housing bubble was created which led to a heavy increase in individual and company debt.]

After 2008, debtors defaulted in droves. That’s what’s actually responsible for the bulk of the reduction in US household debt, rather than repayments. The rest became somewhat more conservative in their saving, borrowing, and spending habits. If not for the boom in government-backed student loans — arguably a form of fiscal stimulus by the back door, albeit a relatively inelegant one that’s likely to become an albatross for many — total household borrowing would have plunged even more and consumption would have recovered even less. Companies borrowed plenty to exploit differences in the cost of equity and bonds, but outside the energy sector, the debt wasn’t financing much additional investment.

Put another way, the big drop in interest rates wasn’t enough to get the private sector to borrow and spend as in the past, although it seems to have stopped borrowers from retrenching even further. It also hasn’t been enough to actually facilitate any deleveraging: the ratio of private nonfinancial debt to national income is the same as it was in 2005, and has been flat since 2012. The post-2000 playbook for dealing with asset busts no longer works.

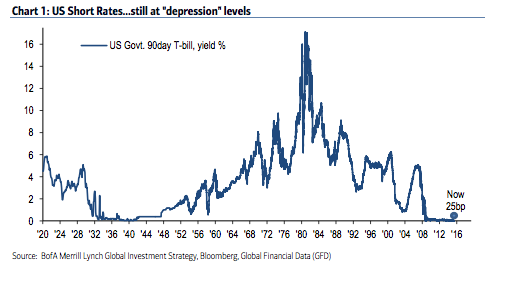

That’s significant. We are now in a world where interest rates can’t go too much lower and household debt service burdens are at their lowest level in decades, yet growth is still sluggish and the current jobs market is still worse than at any point between 1994 and 2008 (at least according to economists at the New York Fed).

The benign interpretation is that higher interest rates therefore won’t matter much. Businesses have locked in low rates for years, if not decades, so changes in policy won’t be felt until after operating cash flows have grown substantially. Down payment requirements matter a lot more than mortgage rates for prospective home buyers. Most US mortgages last decades and don’t float, so higher rates on new loans won’t affect the spending power of current borrowers.

More generally, the appetite for living beyond one’s means by borrowing is probably lower now, on average, than it was before 2008. People who lived through the Great Depression had permanently different spending and saving habits than those who lived earlier, or came later. No matter how much the Fed may want today’s borrowers to cash out their home equity and spend, it’s not happening. Yet the economy is still chugging along. If the transmission mechanism wasn’t working well when the Fed was stepping on the gas, why would we think the same mechanism will suddenly prove potent when the Fed starts stepping on the brakes?

The pessimistic interpretation, which we believe is consistent with what Dalio wrote and what is implied by market prices, is that most of the rich world just doesn’t grow that much unless households and businesses are boosting their debt and eating into their savings. The so-called “Great Moderation” was only made possible by two massive increases in leverage, facilitated by almost non-stop declines in interest rates, plus an equity bubble thrown in the middle. We can’t do that again unless we get a 1940s-style reflation that wipes away private debt burdens and makes future releveraging possible.

Since we didn’t get a Great Reflation, this line of thinking goes, the economy necessarily reverted to its naturally weak state — even after the Fed turned monetary policy up to 11. Thus we have the yawning gap between actual GDP since 2010 and what people expected it would have been before the crisis.

The implication is that any significant cutback in monetary stimulus will quickly cause the economy to sink from steady but mediocre growth into stagnation and then outright recession. One nugget of supporting evidence: practically every central bank that raised rates since 2010 has subsequently reversed course, often bringing short rates down to new all-time lows.

Put into central banker-ese, one possible consequence of being on the wrong side of the long-term debt cycle is that the “equilibrium rate” that ensures stable inflation and full employment is a lot lower than in the past. That limits how much you need to tighten to bring the economy to a halt and also increases the odds of hitting the zero bound in the future, with all that entails.

The Fed clearly agrees with this up to a point, considering how low the “longer-run” policy rate compares with past history. The question is one of degree.

We have no strong view on who’s right, although if forced to choose, we’d side with market prices over central bankers. We probably won’t get an answer for at least a year, since the core issue isn’t when to begin “normalisation” but what the world looks like once policy has finished “normalising”.

Better, though, to avoid the entire argument by having a responsible fiscal policy that lets the private sector deleverage, as in the 1940s. (Just not for the same reasons, please.)" |

A Krugman article from 2002 cited above that was explaining the reason for the housing bubble in the aftermath of 9/11 and the dotcom crash is interesting to read in hindsight: http://www.nytimes.com/2002/08/02/opinion/dubya-s-double-dip.html

[Edited on August 28, 2015 at 10:52 AM. Reason : .] 8/28/2015 10:49:14 AM 8/28/2015 10:49:14 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

Good article, I'd agree with the vast majority of it with a couple things:

When talking about household debt, reflation, etc; why is wage growth never considered as a factor? Is this not a part of reflation? It would certainly be a factor in moving interest rates (if significant positive movement ever occurred).

I wish they would have broken Household debt and business debt apart in that 2nd graph. I was kinda under the impression that household debt was still dropping while corporate (maybe not business debt, not sure) debt had started rising from 2014 to now. I'll see if I can't hunt this data down.  8/28/2015 4:05:26 PM 8/28/2015 4:05:26 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

^ what's your thoughts on neo-Fisherite theory if you've heard about it?  8/31/2015 2:20:57 PM 8/31/2015 2:20:57 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

^I had not heard of it and had to Google.

I've only read/skimmed a few things about it, and I really don't understand the actual mechanism that would cause low interest rates to cause deflation (like what are people doing on the individual level that makes that rational?)? I just haven't found anyone articulate that very well, yet. The only thing I can come up with is people's expectations are so influenced by interest rates that it changes their spending and investment - I find that hard to believe. I get the math side of it, which does make some sense to me, but that just seems totally academic.  9/3/2015 10:37:07 AM 9/3/2015 10:37:07 AM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

^ Yeah, I only heard about it a few weeks ago, instigated by FT Alphaville tweeting the bolded comment:

https://alternativeeconomics.co/blogline/16684-krugman-comes-around

| Quote : | "I opened up my New York Times (literally - I still retrieve the physical NYT from the curb, the bushes, the mud puddle) and was pleased as could be to see that Paul Krugman has finally picked up on what I think is a key idea for understanding macroeconomic behavior post-financial crisis. The essence of the idea is:

"When the housing bubble burst, all that AAA-rated paper turned into sludge. So investors scurried back into the haven provided by the debt of the United States and a few other major economies. In the process they drove interest rates on that debt way down."

I could also add that sovereign debt problems in the world contribute to shortages of safe assets, as do new banking regulations, for example the liquidity coverage ratio requirements in Basel III.

I've written extensively about safe asset shortages, particularly their consequences for monetary policy.

(cut)

A safe asset shortage is actually a property of Krugman's own model, though I'm not sure he ever picked up on this. Krugman used his work with Gauti Eggertsson to back up with formal analysis the kinds of things he was saying in blog posts. So, the Eggertsson/Krugman paper focused on a situation in which the nominal interest rate is at the zero lower bound because of tight borrowing constraints, in which case you can get some welfare benefits from increasing government spending. What fixes the problem in his model, in a clean way, is actually an increase in government debt, which serves to relax borrowing constraints and to raise the real interest rate. That is, because of the safe asset shortage the real interest rate is inefficiently low, and fixing the problem raises the real rate.

Recognizing the existence of a safe asset shortage can help explain a lot of things. For example, you might think that inflation is puzzlingly high. In most models we work with, a long period of zero nominal interest rates would produce a deflation. But, at the zero lower bound on the nominal interest rate, the tighter are the liquidity constraints that bind because of the safe asset shortage, the higher will be the inflation rate. To see how that works, see the papers I listed above.

Safe asset shortages also have a bearing on how we might think about "secular stagnation," which Larry Summers has been talking about. Eggertsson and Mehrotra's "A Model of Secular Stagnation," is, like Eggertsson/Krugman, actually a model of a safe asset shortage. E-M write down a fairly conventional overlapping generations model with some borrowing and lending and a binding borrowing constraint. This economy wants an outside asset badly - both to permit intergenerational trade and to bypass the borrowing constraint. But that's not something the authors consider.

In any case, there's hope for Paul Krugman. Maybe soon he'll be a committed neo-Fisherite." |

When academics bitch at one another, it's a lot of fun. Hey, they're all smarter than me on economics, but when someone attacks their theory, watch out.

If Keynesians and monetarists were both shown wrong at the same time it'd be quite humorous.

[Edited on September 4, 2015 at 11:22 AM. Reason : /] 9/4/2015 11:11:47 AM 9/4/2015 11:11:47 AM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

Decision tomorrow.

Think the going wisdom at this point is they're doing nothing with some people seeing an emerging market-driven global recession that will start in 2016.  9/16/2015 11:28:37 AM 9/16/2015 11:28:37 AM

|

Pupils DiL8t

All American

4904 Posts

user info

edit post |

At this point, does it seem more likely that the Fed will increase interest rates in October or December?  9/17/2015 5:24:26 PM 9/17/2015 5:24:26 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

^ All the heads of the Federal Reserve became more dovish on their forecast, with even one guy calling for negative interest rates.

http://blogs.wsj.com/economics/2015/09/17/parsing-the-fed-how-the-september-statement-changed-from-july/

Wall Street Journal doing a "what was removed/added" from the July statement. I see two additional things of note:

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term."

"The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring developments abroad." (underlined part was only bit added)

from a Financial Times discussion:

"So the median long-run rate forecast is down to 3.5% now. Huh. [Leveraged buyout] everything."  9/18/2015 8:13:59 AM 9/18/2015 8:13:59 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

With all that's to be done in congress between now and January, and considering the GOP clusterfuck in the House, I'd bet the FED does nothing until after the first quarter of 2016.

Remember when the best, number one, complaint toward the Obama whitehouse was how it's rhetoric was killing "confidence" in the trajectory of the economy? It was mostly bullshit, but what we are seeing now is a true crisis of confidence in the potential for growth, and roughly half of that (IMO) is because of the GOP kamikaze caucus in the House.  10/14/2015 9:33:13 PM 10/14/2015 9:33:13 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

| Quote : | "http://www.ft.com/cms/s/0/36faf246-7962-11e5-933d-efcdc3c11c89.html#ixzz3pOGrNF3q

Eurozone government bond yields have dropped to record lows after the European Central Bank came close to promising more action to deflect the risk of prolonged deflation.

Yields on two-year debt now stand below zero for almost every member of the eurozone, which means investors effectively pay to own it. For Italy, yields dipped into negative territory for the first time on Thursday, while German yields for that maturity are now at a record low of -0.327 per cent." |

10/23/2015 7:42:50 AM 10/23/2015 7:42:50 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

I was formerly against QE. You'd probably have to go back to like 2011 or earlier to see those posts but I'm pretty sure they are there. Since then I've become a little more lukewarm about the whole deal, I mean in the face of the government's and corporate refusal to invest in anything, in some ways I've come to view it as an almost necessary evil.

There is some evidence that it enticed the private sector to start borrowing again (if not maybe its circumstantial):

http://www.forbes.com/sites/timworstall/2015/11/02/soaring-corporate-bond-issues-show-that-the-federal-reserves-qe-really-did-work/

Of course there is always a catch, I personally believe that the private sector has done a pretty shitty job of where it has allocated that money, basically chasing short-term stock targets:

http://www.bloomberg.com/news/articles/2015-11-02/here-s-how-much-qe-helped-wall-street-steamroll-main-street

| Quote : | | "For every job created in the U.S. this decade, companies spent $296,000 buying back their stocks, according to the New York-based bank." |

11/2/2015 7:31:42 PM 11/2/2015 7:31:42 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

Rabble rabble rabble  12/16/2015 2:59:23 PM 12/16/2015 2:59:23 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

You look at the U.S., you look at Europe, and you look at Japan, I don't see what it accomplished outside of beggar-thy-neighbor. The goal of QE was to create inflation and it largely failed at the most accomodative Fed funds rate possible to induce inflation -zero. They stayed too long and now the commodities crash will plunge us into outright deflation, gamed economic indicators or not.

[Edited on December 17, 2015 at 8:22 AM. Reason : .]  12/17/2015 8:01:24 AM 12/17/2015 8:01:24 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

^are you basing that last part about commodities on the neo-fisherite stuff you mentioned a few posts up? Otherwise I'm not seeing the connection between a plunge in commodity prices and QE.

And while you are right that QE failed to inflate anything I would point out that it didn't happen in a vacuum. QE "may" have kept us propped up in the face of some pretty extreme austerity and lack of investment from both the public and private sector. There is also the question of (purely hypothetical so prob not worth arguing) how bad would the recession have been without QE?  12/17/2015 10:55:23 AM 12/17/2015 10:55:23 AM

|

CuntPunter

Veteran

429 Posts

user info

edit post |

QE failed to inflate anything...except homes and stock prices...so, nothing.  12/17/2015 8:01:23 PM 12/17/2015 8:01:23 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

12/17/2015 9:59:24 PM 12/17/2015 9:59:24 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

I share concern for both these sectors.

Let me change my statement and say that QE inflation predictions have not shown up in any of the typical methods we use to measure inflation.

I really do think that QE has mostly trickled into the stock market through stock buybacks (per link a few posts up), although investors have supposedly been pricing in the end of QE for atleast a year. We will see the effect soon enough.

Housing prices could just as easily be driven by limits in supply as QE, especially when you consider only the last 2-3 years.  12/17/2015 10:01:35 PM 12/17/2015 10:01:35 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

Commodity price crash is just going to instigate goods dumping, which creates deflation. Leaving aside the Saudis trying to crash the price of oil to drive Americans, Russians, Iranians, et al out of the oil profitability business, Chile for example are doing the same thing with copper of they're not going to reduce the amount of copper they mine in order to protect their market share, and China have far far far more steel than they're using. High yield bonds are threatening going down...when we were at ZIRP and have now gone all the way up to 0.25%.  Silicon Valley unicorns have peaked and the tide's going out. Actually you want to look at an example of QE and you can see it in Silicon Valley unicorns getting tons of money thrown at them for what are mostly going to wind up being unproductive uses of money. Silicon Valley unicorns have peaked and the tide's going out. Actually you want to look at an example of QE and you can see it in Silicon Valley unicorns getting tons of money thrown at them for what are mostly going to wind up being unproductive uses of money.  12/17/2015 10:05:16 PM 12/17/2015 10:05:16 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

so what you're saying is........QE4 is IMMINENT.........  12/17/2015 10:31:12 PM 12/17/2015 10:31:12 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

Yeah, because QE1 through 3 worked so well they're now up to #4.   12/18/2015 5:55:08 PM 12/18/2015 5:55:08 PM

|