Flyin Ryan

All American

8224 Posts

user info

edit post |

CNBC:

| Quote : | | "Shares of Apple dropped almost 4 percent at Friday mid-day, down more than 19.7 percent from the stock's 52-week high. If shares drop more than 20 percent off the yearly high, Apple will join nine other Dow components already in bear market territory: Proctor & Gamble, IBM, Exxon, Intel, Walmart, Caterpillar, United Technologies, Chevron, and DuPont. " |

8/21/2015 3:05:21 PM 8/21/2015 3:05:21 PM

|

theDuke866

All American

52653 Posts

user info

edit post |

Yep, was just watching that on CNBC.

If this holds until close, I think we'll either officially have a correction, or else be within just a few points of it.  8/21/2015 3:06:39 PM 8/21/2015 3:06:39 PM

|

Mr. Joshua

Swimfanfan

43948 Posts

user info

edit post |

Dow down 530.

Correction.   8/21/2015 4:14:06 PM 8/21/2015 4:14:06 PM

|

Kurtis636

All American

14984 Posts

user info

edit post |

I still like Apple in the long term, I think their product offering is pretty mediocre but as a company I like their ability to acquire or develop new markets because they still have a massive amount of cash.

Walmart on the other hand is long term fucked, I think most large retailers are going to have a very tough time. It's one of the reasons I'm actively looking to leave my rather nice paying job with a large retailer.  8/21/2015 6:41:21 PM 8/21/2015 6:41:21 PM

|

moron

All American

33712 Posts

user info

edit post |

^ they're going to get netflixed if they're not careful. If I were Walmart I'd leverage the existing logistics prowess to launch an Amazon-like shopping site with free shipping for as many things as they can manage.  8/21/2015 6:47:02 PM 8/21/2015 6:47:02 PM

|

Kurtis636

All American

14984 Posts

user info

edit post |

It's borderline too late for them, and it may actually be too late. I don't have quite as much insight into Walmart as I do other places, but it was too late for a lot of companies before they even realized it, just ask Circuit City.

So many people scoffed at Amazon when they talked about becoming the everything store, but they're now the #9 retailer in the US by sales and continuing to shoot up the chart.

Walmart may have the infrastructure to pull off a big pivot to online focus, but they're hamstrung by the capital they have tied up in having 5000 stores. Margins are razor thin, even for Walmart and they are basically playing catch up to a company with none of those liabilities. I've only used their website a few times to try to order things and the experience was abysmal and I have a feeling the mobile experience is probably as bad or worse. Personally I think that's why they're putting so much energy towards broadening their appeal and footprint as a grocer with a couple of different store types being tested and rolled out.

Target, which targets a slightly wealthier, younger, and tech savvier consumer and has tried harder than Walmart to engage consumers in multi-channel shopping is still doing a shit job of it in my opinion compared to Amazon.

The day of the brick and mortar general merchandise store may be over, and if 3D printing starts to happen in a big way within the decade it's going to be that much worse for big box places.  8/21/2015 7:04:04 PM 8/21/2015 7:04:04 PM

|

Noen

All American

31346 Posts

user info

edit post |

^^ Walmart DOES already have an Amazon-like shopping site with free shipping on nearly everything.

It's called Walmart.com. It's a completely different entity than Walmart retail. If the retail business does close up shop, Walmart.com won't be effected. It's one of the reasons their web experience is so fucking terrible. People WANT to be able to buy something online and then go pick it up in the store, but since they are two separate businesses (just with the same brand name), it gets screwed up constantly.

If they actually integrated the businesses, specifically the inventory and logistics, I would be apt to use Walmart a lot more often. But seeing an item online and having the option for free shipping (which takes 2-3 days generally) or free ship to store for pickup (which takes 5-7 days) is a complete joke.  8/22/2015 5:06:24 PM 8/22/2015 5:06:24 PM

|

Kurtis636

All American

14984 Posts

user info

edit post |

It has a lot to do with the fact that distribution centers for traditional retailers are not set up to ship direct to consumers. They're trying to move that way, but it's taking gar too long and consumers don't usually switch once they've already found a shopping solution.

Target.com allows you to purchase online and pick up in store, but selection is limited to what is available in store, so it's really just personal shopping (which is convenient, sure but not a game changer).

Walmart.com or Target.com have no competitive advantage over amazon. They can't really utilize existing facilities without a major retool. That's why I think they're kind of hosed. I think you're going to see major retailers moving away from consumer staples and more towards things that people need to see/feel to purchase. Clothing is still a very hands on experience, so is food, and so is at of stuff for kids (toys, almost anything for babies).  8/22/2015 5:37:52 PM 8/22/2015 5:37:52 PM

|

Elwood

All American

4013 Posts

user info

edit post |

F  8/24/2015 9:28:17 AM 8/24/2015 9:28:17 AM

|

Dynasty2004

Bawls

5812 Posts

user info

edit post |

if you were gonna buy some stock today...what would you buy?  8/24/2015 9:39:44 AM 8/24/2015 9:39:44 AM

|

bbehe

Burn it all down.

18369 Posts

user info

edit post |

Thanks Obama China  8/24/2015 9:48:23 AM 8/24/2015 9:48:23 AM

|

OmarBadu

zidik

25060 Posts

user info

edit post |

blood bath  8/24/2015 9:56:11 AM 8/24/2015 9:56:11 AM

|

bbehe

Burn it all down.

18369 Posts

user info

edit post |

I wouldn't buy shit for at least another day or two, most likely a week  8/24/2015 9:57:56 AM 8/24/2015 9:57:56 AM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

If brick and mortar stores shutdown, where are all those low-skilled people going to work?

And if low-skilled people can't get jobs, how is that positive long-term for a company like Apple that is based on consumer spending?

[Edited on August 24, 2015 at 10:02 AM. Reason : .]  8/24/2015 9:58:52 AM 8/24/2015 9:58:52 AM

|

moron

All American

33712 Posts

user info

edit post |

a couple of stocks (seems some tech) is up for the day now.  8/24/2015 12:00:06 PM 8/24/2015 12:00:06 PM

|

Kurtis636

All American

14984 Posts

user info

edit post |

| Quote : | | "If brick and mortar stores shutdown, where are all those low-skilled people going to work?" |

Eslewhere along the supply chain. Still going to need people to load boxes, drive trucks, work at distribution/packing centers, etc.

I don't think brick and mortar is entirely doomed. There will still be a lot of specialty places, high end stores, places that require a physical shopping experience (like buying fresh produce), etc.

Our whole economy is going to change once we get to a 3D printing/nanotech convergence. When you can make everything at home with very little effort and energy it's going to be a radically different world. IP is going to be even more important then. You'll also see a lot fewer people actually needing to work, so motivations will need to change. We're getting closer to another paradigm shift with consumer goods the way that the internet has fundamentally changed access to information and media. 8/24/2015 5:54:13 PM 8/24/2015 5:54:13 PM

|

Geppetto

All American

2157 Posts

user info

edit post |

why would fewer people need to work?  8/25/2015 9:30:12 AM 8/25/2015 9:30:12 AM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

| Quote : | | "Eslewhere along the supply chain. Still going to need people to load boxes, drive trucks, work at distribution/packing centers, etc." |

Drive trucks and work at distribution centers? They'll all be replaced by drone delivery systems.

| Quote : | | "Our whole economy is going to change once we get to a 3D printing/nanotech convergence. When you can make everything at home with very little effort and energy it's going to be a radically different world." |

Allright, so all low-scale manufacturing jobs are obsolete, as are the people loading boxes, driving trucks, working at distribution/packing centers for those items that you just talked about earlier in your post, so you're contradicting yourself here. How can those positions increase to accommodate the people left unemployed by brick and mortar stores going if those jobs themselves will also decline due to your vision of the future?

| Quote : | | "IP is going to be even more important then." |

The same IP that is willfully ignored by ever more people, including sovereign governments. (I've actually dealt with Chinese engineers, don't tell me they don't.)

Look, if you think that's where the world's going, great. But Apple is based on consumers spending bukus of money for a phone with wifi access. If there's 20% unemployment and a lot of the employed are in minimum wage service jobs, it's bad for Apple long-term if people increasingly can't afford an expensive "want" item.

[Edited on August 25, 2015 at 2:57 PM. Reason : /] 8/25/2015 2:38:56 PM 8/25/2015 2:38:56 PM

|

Kurtis636

All American

14984 Posts

user info

edit post |

It's not contradictory, I'm looking at a few different time horizons here.

Brick and mortar is pretty hosed in the medium term as in within a decade or so, some more than others and (best buy is probably only around another 5 years for example). Walmart won't disappear but they'll have to change a lot of things about their business model and will lose their dominance as a retailer in the not too distant future.

The amazon style consumer model is probably going to be dominant until home manufacuring and nano technology become affordable and common place. Once we can start making basic goods at home that'll completely shift everything. At that point I don't think we can have anything close to the corporatist consumer economy we currently have. If you've ever read The Diamond Age I wouldn't be surprised to see some of the stuff in there come to pass.

As for Apple, they'll shift what they make and what they sell. Like I said, they're the richest company in the world. They can't continue to rely on just selling phones, they'll acquire other companies and start doing more than making consumer electronics. I think there's a decent chance Apple shifts towards media content and distribution not too long from now.

Somebody is going to make a huge push in making 3D printing a thing, whether it's GE or Apple or Google, or we have somebody out there who figures out matter compiling via a breakthrough technology. That's the real game changer, and that's when shit is going to get crazy. I might be a bit tin foil hat here, but I think one of the reasons there's provisions in the TPP to protect IP is because of China and how valuable IP is going to be once anybody can make shit at home.  8/26/2015 12:09:07 AM 8/26/2015 12:09:07 AM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

| Quote : | | "(best buy is probably only around another 5 years for example)." |

How much you want to bet? (Seriously, how much money do you want to bet? I'm betting that Best Buy will exist on August 26, 2020.)

| Quote : | | "The amazon style consumer model is probably going to be dominant until home manufacuring and nano technology become affordable and common place. Once we can start making basic goods at home that'll completely shift everything. At that point I don't think we can have anything close to the corporatist consumer economy we currently have." |

That's the height of delusion. You'll have a hugely enriched one percent that control through IP everything new that is made (Silicon Valley and where all the Googles and Facebooks and Amazons of the world are going if you read up on it is the height of corporatist dictatorship and vertical integration in an industry), manufacturing will disappear or greatly decline when since the Industrial Revolution it has always been a way to bring poorer classes a middle-class living, the people that do have jobs will be in the low-end service industry (although who these people will serve when only the rich one percent have money is unclear). You've also put most every store out of business, so large sections of cities across the entire nation will represent inner-city Detroit unless governments spend money to reclaim these areas with a wrecking ball and jackhammers.

Where we're going is the feudalism of the Middle Ages where the barons and lords are not government agents, but the Zuckerbergs of the world. Unlike the Middle Ages though, we'll all be interconnected on the internet so we can share our misery with one another. At least in the Gilded Age of the 1890s where a handful of business elites controlled the country, people actually had jobs.

So again, how can a company based on consumption with the general deflation of the standard of living that technology is bringing be in good shape long-term?

[Edited on August 26, 2015 at 4:11 PM. Reason : /] 8/26/2015 4:08:33 PM 8/26/2015 4:08:33 PM

|

Kurtis636

All American

14984 Posts

user info

edit post |

| Quote : | | "Where we're going is the feudalism of the Middle Ages where the barons and lords are not government agents, but the Zuckerbergs of the world. Unlike the Middle Ages though, we'll all be interconnected on the internet so we can share our misery with one another. At least in the Gilded Age of the 1890s where a handful of business elites controlled the country, people actually had jobs." |

Nah, there will still be work and jobs, they'll just be different and there well may be fewer people who have to work. We may actually be able to return to a model where you don't have as many families where mom and dad both have to work. I think we may be about to enter an era where labor saving devices actually save labor instead of just boosting efficiency.

Interestingly a pretty decent piece on reason.com just talked about this today.

http://reason.com/blog/2015/08/28/why-are-there-any-jobs-still-left

Labor markets evolve, and sometimes large industries just disappear. NC used to be hugely reliant on producing tar and pitch for shipbuilding, but we didn't all become destitute and unemployed when other modes of travel and transport rendered shipping less vital. We aren't all fucked because someone invented the car and now farriers, saddlemakers, carriage builders, etc. are looking for work.

As for apple, good companies (and even mediocre ones with a ton of free capital) are able to evolve. Apple is probably not going to be as heavily reliant on consumer electronics in the future. I think there's a reason they are aggressively going after domination of the subscription music space and so many people are encouraging them to start creating original programming. AppleTV is cool and all, but it would be even better if there was exclusive content.

I also want to point out that I've been banging away about the importance of reforming IP laws for about a decade now. We need to shorten copyright periods and force patents to be extremely specific and hard to acquire. Patent trolls are a bad enough problem, but the possibility for a handful of companies to dominate the world based on IP is very real. Ownership of an idea is nebulous enough as a concept, it certainly shouldn't last very long once you introduce it for public consumption. You come up with a really clever new device, fine you can own the rights to it for a couple of years, but once it becomes ubiquitous it enters the public domain and anyone can manufacture it.

[Edited on August 28, 2015 at 11:56 PM. Reason : IP reform] 8/28/2015 11:51:32 PM 8/28/2015 11:51:32 PM

|

slackerb

All American

5093 Posts

user info

edit post |

Just got into the market for the first time with some disposable cash.

I'm looking for long term gains, and invested in some mutual funds, some Disney, and GoPro as my fun stock.

Now it looks like my 1 "risky" pick is hemorrhaging.

Any opinions on GoPro?  9/3/2015 4:28:18 PM 9/3/2015 4:28:18 PM

|

Doss2k

All American

18474 Posts

user info

edit post |

I was in GoPro for a while but there is a lot of fear out there on them I believe as with most companies who have something people want to buy. China and other countries are now going to make a similar product that is much cheaper to buy and is comparable. The good thing is GoPro is trying to get a lot of deals done from what I hear with things like the major sports leagues to try and put wearable cameras on athletes during games and things like that. They are going to have to evolve or find ways to keep people in their "ecosystem" like everyone else is trying to do otherwise very soon people will just buy the cheaper knock off brand that does basically the same thing.  9/4/2015 8:41:00 AM 9/4/2015 8:41:00 AM

|

SuperDude

All American

6921 Posts

user info

edit post |

I'm not sure if cheap Chinese knockoffs will have a huge impact on GoPro. They will come, but my experience is that most consumers don't want cheap, no-name brands. And if it came from a reputable Chinese or Taiwanese brand, it's likely to cost just as much.

I'd be more worried about news of Apple or Google or Samsung trying to get into the camera game.  9/5/2015 8:49:32 AM 9/5/2015 8:49:32 AM

|

Mr. Joshua

Swimfanfan

43948 Posts

user info

edit post |

| Quote : | | "I'd be more worried about news of Apple or Google or Samsung trying to get into the camera game." |

That's always been my fear. It doesn't seem like a very big moat to prevent other companies from stealing some of their market share.

Also what's the product life cycle? Are people replacing older GoPros with newer models or do 90% of consumers get one for Christmas, take it on a ski trip, and then never use it again? 9/5/2015 8:04:42 PM 9/5/2015 8:04:42 PM

|

Crede

All American

7337 Posts

user info

edit post |

I think you are overestimating how many gopro consumers there truly are. That market volume has to be in the thousands.

*ETA: Hundred thousands, sure

[Edited on September 6, 2015 at 9:29 AM. Reason : .]  9/6/2015 9:28:38 AM 9/6/2015 9:28:38 AM

|

dtownral

Suspended

26632 Posts

user info

edit post |

they've sold millions of the things  9/8/2015 10:56:50 AM 9/8/2015 10:56:50 AM

|

slackerb

All American

5093 Posts

user info

edit post |

Welp I decided to jump into my first single stock with GoPro.

That hasn't turned out well so far, pretty much looking like the worst thing I could have done in the short term.

Just gonna ride it out long and hope it recovers for the holidays.  9/11/2015 11:03:59 AM 9/11/2015 11:03:59 AM

|

Kurtis636

All American

14984 Posts

user info

edit post |

Yeah, I wouldn't have touhed GoPro with a 10ft pole. It seemed like they had just about reached market saturation with their core business by the time they had their IPO.

Out of curiosity, why did you choose to put money into them?

On the other hand, I wouldn't freak out too much, just about everything has been losing money in the short term here, once the fed finally figures out what they're going to do I think there will be some stabilization, and as long as China keeps on shitting its pants you may see money coming into the US markets, so there is a decent chance for a market wide bounceback.  9/13/2015 11:26:05 PM 9/13/2015 11:26:05 PM

|

slackerb

All American

5093 Posts

user info

edit post |

Like I said, I don't know much. GoPro was at an 8 month low and I thought it was a good value and would bounce back up, especially for the holidays.

I like the product and I read a report somewhere that rated it as a buy.

So I jumped in.

I'm not terribly bummed since the overall market is losing since I bought in, but GoPro has been hammered almost the hardest. I'm committed to just ride it out and hope they don't ride it into the dust.  9/14/2015 1:19:18 PM 9/14/2015 1:19:18 PM

|

OmarBadu

zidik

25060 Posts

user info

edit post |

Picked up MOBL - can't imagine it going much lower  9/14/2015 2:02:27 PM 9/14/2015 2:02:27 PM

|

hershculez

All American

8483 Posts

user info

edit post |

^ Abruptly changing their CFO and dealing with a lawsuit related to misleading shareholders does not concern you? I would probably want to see consistent progress from them. People probably thought it could not go much lower when it dropped from 11 to 5. Hope you are right though and make a bunch of money. I can definitely understand the appeal of a few hundred shares because the loss would be pretty minor.

[Edited on September 15, 2015 at 11:01 AM. Reason : df]  9/15/2015 11:00:56 AM 9/15/2015 11:00:56 AM

|

Noen

All American

31346 Posts

user info

edit post |

I know most of the design team at GoPro. While not terribly overvalued, there's no growth left for the company without some crazy pivot to new markets (which I don't think they are doing, planning, or could pull off even if they wanted to).

I think FitBit is approaching a buy, I still have a standing order at $30. Unlike GoPro, fitbit has the ability and technology to pivot.

My BIG winner from the selloff blip a few weeks ago is The Fresh Market (TFM). Up 25%. Also bought into Whole Foods. I don't think either company has much big growth opportunity long term, but they were both at or near all time lows with P/E dipping in the teens.

[Edited on September 15, 2015 at 11:53 AM. Reason : .]  9/15/2015 11:48:56 AM 9/15/2015 11:48:56 AM

|

Kurtis636

All American

14984 Posts

user info

edit post |

Grocers are so dangerous. Profit margins are razor thin and they very rarely have the ability to maneuver when markets change. For right now I think places like Whole Foods and Fresh Market are probably safer plays than a normal grocer like Publix or Harris Teeter.  9/15/2015 4:57:51 PM 9/15/2015 4:57:51 PM

|

moron

All American

33712 Posts

user info

edit post |

| Quote : | "they've sold millions of the things

" |

Saw a guy at Disney over the summer using one on a stick, just walking around video taping stuff... pretty odd usage, but i guess that's what good marketing causes. 9/16/2015 12:16:30 AM 9/16/2015 12:16:30 AM

|

moron

All American

33712 Posts

user info

edit post |

Tesla is up today, even after both Audi and Porche announce products that compete directly with their own. Pretty interesting...  9/16/2015 4:10:22 PM 9/16/2015 4:10:22 PM

|

Noen

All American

31346 Posts

user info

edit post |

^^^ Exactly why I invested. All of the "health" food grocery chains have insanely high profit margins compared to traditional super markets.  9/16/2015 7:19:51 PM 9/16/2015 7:19:51 PM

|

Ribs

All American

10713 Posts

user info

edit post |

^^ probably the powerwall news

Once tesla gets that gigafactory up and running they're going get real valuable.  9/17/2015 8:08:49 PM 9/17/2015 8:08:49 PM

|

theDuke866

All American

52653 Posts

user info

edit post |

VW is down about a third in the last couple of days, and at less than half of their pre-correction highs. PE of 5, dividend yield of 4%. I think the diesel scandal is going to be a HUGE catastrophe for them, way worse than most people realize, but I still have to wonder if this is a good long-term buying opportunity.

Also, BMW and Daimler are down 6-7% of this news, too, and is has nothing to do with them.  9/22/2015 11:06:23 PM 9/22/2015 11:06:23 PM

|

HaLo

All American

14083 Posts

user info

edit post |

A) dividend?!? Ha, that dividend is gone I'm sure

B) big risk buying in now, I still don't think they've hit their low, I'm wagering that it's going to take a while to recover so is this really the best investment?  9/22/2015 11:51:09 PM 9/22/2015 11:51:09 PM

|

David0603

All American

12759 Posts

user info

edit post |

Yeah, like trying to catch a falling knife...  9/23/2015 9:34:07 PM 9/23/2015 9:34:07 PM

|

Kurtis636

All American

14984 Posts

user info

edit post |

http://www.cnbc.com/2015/10/14/wal-mart-plunge-is-tipping-point-for-e-commerce-vc.html

So, not a good sign for Walmart. The brick and mortar dominance may be ending even sooner than it looked like.

I also think long term electric vehicles may not be the right place to look. There's so much infrastructure that will have to be put in place to support it that it may not be worthwhile as things like hydrogen fuel cell technology gets better. It's one of the things that keeps me away from Tesla.

Ultimately the play is going to hydrogen powered once that is figured out. It's not going to be all that long either. Honda and BMW are going to put one in the market within 20 years IMO.  10/14/2015 6:05:14 PM 10/14/2015 6:05:14 PM

|

CuntPunter

Veteran

429 Posts

user info

edit post |

Twenty years huh? Better just plan on hydrogen then because batteries and materials definitely aren't going to get me over my range anxiety with another 20 years to develop and improve.  10/14/2015 8:04:44 PM 10/14/2015 8:04:44 PM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

Re Tesla stock price, from two months ago:

http://ftalphaville.ft.com/2015/08/10/2136975/engineering-cult-value-elon-musk-edition/

"Elon Musk isn’t just an eccentric visionary with a penchant for Bond-villain scale thinking, he’s a branded cult phenomenon. The man is known for thinking absolutely anything is possible provided enough hard work and belief are thrown at it.

Hyper loops? Check. Manned missions to Mars? Check. AI annihilation? Check. If Elon can dream it, he can make it happen.

But there are those who never bought the Musk hype.

Take Craig Pirrong, the Streetwise Prof, as an example. He questions the entrepreneur’s visionary credentials on the grounds that so much of his wealth is derived from government handouts or old-school rent seeking models.

As recently as June, Pirrong noted:

| Quote : | | ""Elon Musk is a rent seeker masquerading as a visionary. If he is one-tenth the innovator and genius his fawning fans believe him to be he wouldn’t need any subsidies. We should give him the chance to prove it." |

Pirrong really knows his stuff when it comes to market structure and price manipulation. He literally wrote the book about it. So when the Streetwise Prof questions the legitimacy of Musk-associated company stock price runs, it pays to listen.

Readers will recall that the price of Tesla stock experienced an almost bitcoin-esque explosion a few years back for no openly explainable reason.

One morning Tesla stock was worth sub $50, the next morning it was worth $100. Even today one consistent characteristic of the stock is that it remains hugely volatile:

But as the Prof noted in May 2013, there is a helluva lot to be concerned about when it comes to Tesla’s valuation. Not just the now 85x forward earnings valuation or enterprise value to EBITDA ratio of 1770x (!), but the degree to which a literal bonfire of Tesla shorts accompanied the stock explosion.

Pirrong suspected the mother of all short squeezes may have been responsible. And to prove his point he’d crunched the numbers too:

| Quote : | "In the absence of manipulation, the forward price of a stock should be the current spot price plus the cost of financing the position at the prevailing interest rate until the delivery date on the forward. In the absence of a squeeze, the cost/fee to borrow the stock should be small.

However, in a squeeze, it is costly to borrow the stock: the bigger the squeeze, the bigger the cost of borrowing. This borrowing cost depresses the forward price. Thus, during a squeeze, the forward price is below the spot price plus financing costs. The differential between these is a measure of the severity of the squeeze. I can’t observe borrowing costs directly, and there is no explicit forward market for Tesla stock. But there is an options market that trades fairly actively.

Given put and call prices, and the associated strike prices, I can use put call parity to estimate an implied forward price: F=(1+rT)(c-p)+K where c is the call price, p is the put price, K is the strike price, r is the interest rate (I use Libor), and T is the fraction of a year to expiration of the option.

I do this for every strike on Tesla options expiring in May, June, and September: there is one implied forward price for every strike.

I then use the median and average across strikes (for each expiry) to estimate F. I then compare F to the no-squeeze forward price, which is (1+rT)S where S is the current price on the stock. (There is little disparity in my estimate of F across strikes, and the mean and median are virtually identical: this gives me confidence that the numbers are solid.)" |

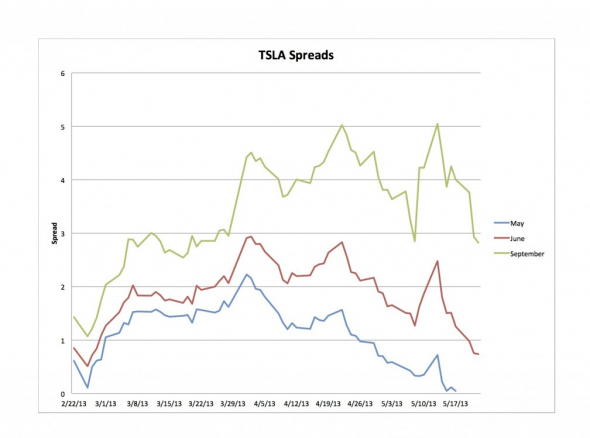

Thus he arrived at the following chart depicting the spread between the no-squeeze forward price and the actual forward price, in which positive values imply a squeeze is going on:

That’s some serious evidence of a squeeze, according to the Prof.

He further added that the “interest rate” on paid to borrow Tesla stock ranged from between about 25 per cent (to borrow until 21 September) and 45 per cent (to borrow to 17 May). Not quite loan-shark pricing, but not far off it either.

In any case the Prof didn’t mince words with his conclusion:

| Quote : | | "One other thing stands out. Note the spike in spreads on 13 May. Which just happens to be two days before Tesla announced its secondary public offering. Interesting. Very interesting. I wonder if the SEC is interested. It should be." |

All squeezed stocks (Bitcoin, ahem) eventually correct. Pirrong believes it’s only a matter of time until Tesla’s price will correct too. The only question really is when (since there’s nothing like a burnt-short trauma to artificially extend the duration of a mispricing)." 10/15/2015 6:57:44 AM 10/15/2015 6:57:44 AM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

continued:

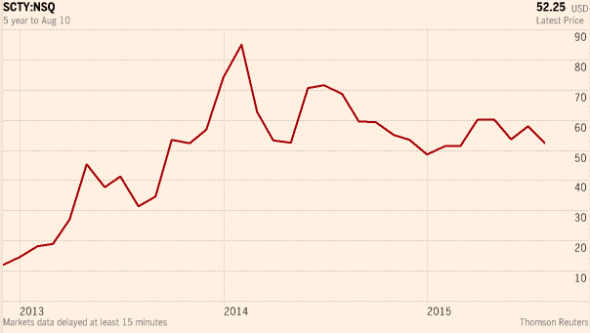

"But Pirrong’s valuation concerns don’t just apply to Tesla. He detected a squeeze-related footprint on another Musk interest, SolarCity, too:

Again, it was down to the exploding borrowing costs at the time of the stock’s appreciation. Read about it here.

But what we’re really interested in at this point is Katie Fehrenbacher’s Fortune report highlighting how Musk-associated companies like to help each other out on the cost of capital front. This is nice and friendly for sure. But, as Climateer Investing notes, it’s also the first thing they teach you in junior forensic analyst school to look out for.

According to Fehrenbacher story in the last six months SpaceX (Musk’s commercial space enterprise where he is the CEO) has invested $165m in a new SolarCity investment product.

When asked why, SolarCity’s vice president for financial products told Fehrenbacher the bonds offered SpaceX an attractive rate of return for a one-year investment compared to other investment options out there and since the company carries a lot of cash well hell why not?!

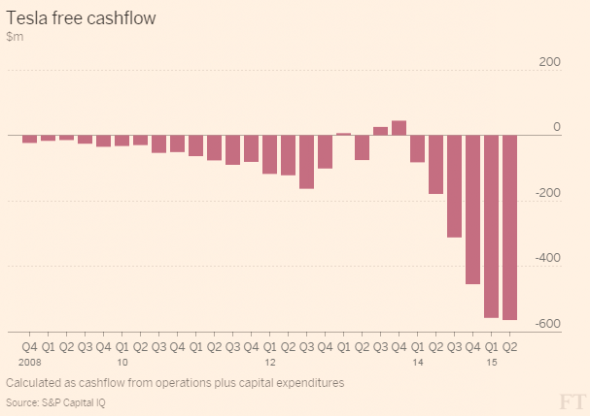

In any case, Tesla’s results last week confirmed the electric car maker is losing more than $4,000 on every Model S electric sedan it sells, burning $358m in cash the last quarter alone. The results also included a vehicle sales target warning.

Musk has said he will seek more capital and won’t rule out selling more stock. But of course Tesla stock is already habitually diluted by way of its equity incentive and employee stock purchase plans.

Can Tesla afford to offer more stock to market when its valuation is so dependent on keeping supply out of the securities lending market?

As Lex graphed last week, the company’s free cashflow metrics suggest it might not have a choice:

Who was it again that said 'the bigger the lie, the more it will be believed'?"  10/15/2015 6:59:25 AM 10/15/2015 6:59:25 AM

|

Flyin Ryan

All American

8224 Posts

user info

edit post |

http://ftalphaville.ft.com/2015/08/17/2137524/this-is-nuts-whens-the-crash-27/

| Quote : | "

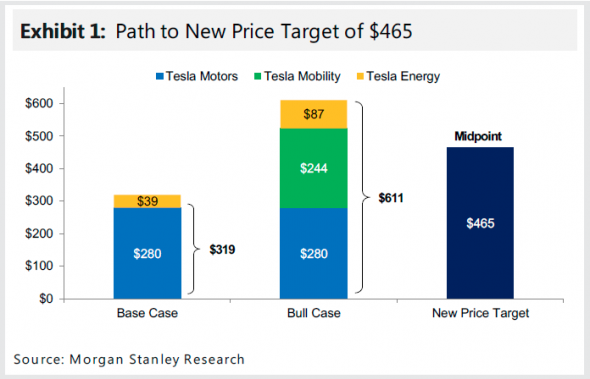

A chart, via Bloomberg, of the latest piece of research on Tesla to be issued by Morgan Stanley.

Last week the bank helped Tesla sell $0.5bn worth of stock, in an issue where the loss making electric car company’s largest shareholder, Elon Musk, declined to purchase enough shares to prevent dilution of his holding.

This week, analyst Adam Jonas said Tesla stock could be worth $465 per share, which would value it at about $60bn.

To put it another way, that would value the company at more than $1m for each electric car it will produce this year.

However, the future is batteries and driverless cars: Tesla Mobility, according to Mr Jonas, is key to the 2029 revenue forecast.

If any readers have investment bank research from circa 2000, which included sales forecasts for 15 years into the future, we would be delighted to see them." |

Commenters wondered about other car companies and how their values compared per car produced.

Ford: $58 billion, about 6 million vehicles per year, or $1000 per car

Volkswagon (this was pre-ECU cheating): about $800 per car

Then thought they should do a low-volume car maker to compare apples to apples to Tesla, and FIAT are about to list Ferrari shares:

Ferrari, 7000 cars per year and if you took a value of $1 million per car, you say it's worth $7 billion. Which led to this comparison:

| Quote : | "I am not a supporter of Ferrari, but the thing is:

- Ferrari shows revenues of > 2.5 bn (approx. EUR 300k per car)

- Tesla shows revenues of 3.2 bn (approx. USD 60k per)

- Ferrari shows a profit of > EUR 300m (>30k per car)

- Tesla is in the reds as we know (obviously the same per car)

- Ferrari's expected market value would be around 10 bn

- Tesla's current market value is already > 33 bn

Now, do the maths without the growth rates ..... If investors are not THAT interested in the Ferrari IPO, why should they buy Tesla at current prices / valuations instead?" |

10/15/2015 7:17:56 AM 10/15/2015 7:17:56 AM

|

Doss2k

All American

18474 Posts

user info

edit post |

I went short on TSLA several times and got burned every time. What the market should do and what it actually does are very often very different.  10/15/2015 8:25:17 AM 10/15/2015 8:25:17 AM

|

CaelNCSU

All American

6883 Posts

user info

edit post |

^ I did the same three times, and I got lucky the first two and lost my ass on the third.

| Quote : | | "Also what's the product life cycle? Are people replacing older GoPros with newer models or do 90% of consumers get one for Christmas, take it on a ski trip, and then never use it again?" |

It's a small market, but I see a lot of people doing that in my hobbies. Most of the newer ones have terrible life. I've had two break on me and my wife's won't turn off after it starts recording. I wish a decent one would come out that didn't seem like it was made in Chinese garage.

| Quote : | "If brick and mortar stores shutdown, where are all those low-skilled people going to work?

And if low-skilled people can't get jobs, how is that positive long-term for a company like Apple that is based on consumer spending?

" |

The low skilled will get jobs in cities that have the population to support them. The people making money still need people to drive them around (Uber) and get their groceries (InstaCart). The ones that don't do that will go to prison because of drugs, or get on disability for a made up disease. The new economy is already in full effect, I'm just not sure how it's going to effect rural places--meth?

[Edited on October 15, 2015 at 9:48 AM. Reason : a] 10/15/2015 9:47:18 AM 10/15/2015 9:47:18 AM

|

wahoowa

All American

3288 Posts

user info

edit post |

I dont even bother with TSLA. Those investors are either time travelers, googly-eyed superfans, or just plain crazy. Nothing makes sense with that stock.  10/15/2015 10:32:59 AM 10/15/2015 10:32:59 AM

|

Kurtis636

All American

14984 Posts

user info

edit post |

| Quote : | | " Twenty years huh? Better just plan on hydrogen then because batteries and materials definitely aren't going to get me over my range anxiety with another 20 years to develop and improve." |

Oh, I'm sure that all of those things will improve, but I don't there will be enough infrastructure or cost savings in place for it to beat out hydrogen once that reaches the market. Internal combustion is going to hang on for quite a while as well. I just don't see electric ever being the dominant form of automobile.

The only way it could really work is of we harness solar to the point that the car could run directly off its own solar collection. 10/15/2015 11:13:01 AM 10/15/2015 11:13:01 AM

|