HCH

All American

3895 Posts

user info

edit post |

| Quote : | | "GOP will never touch the real solution which is sane wealth taxing." |

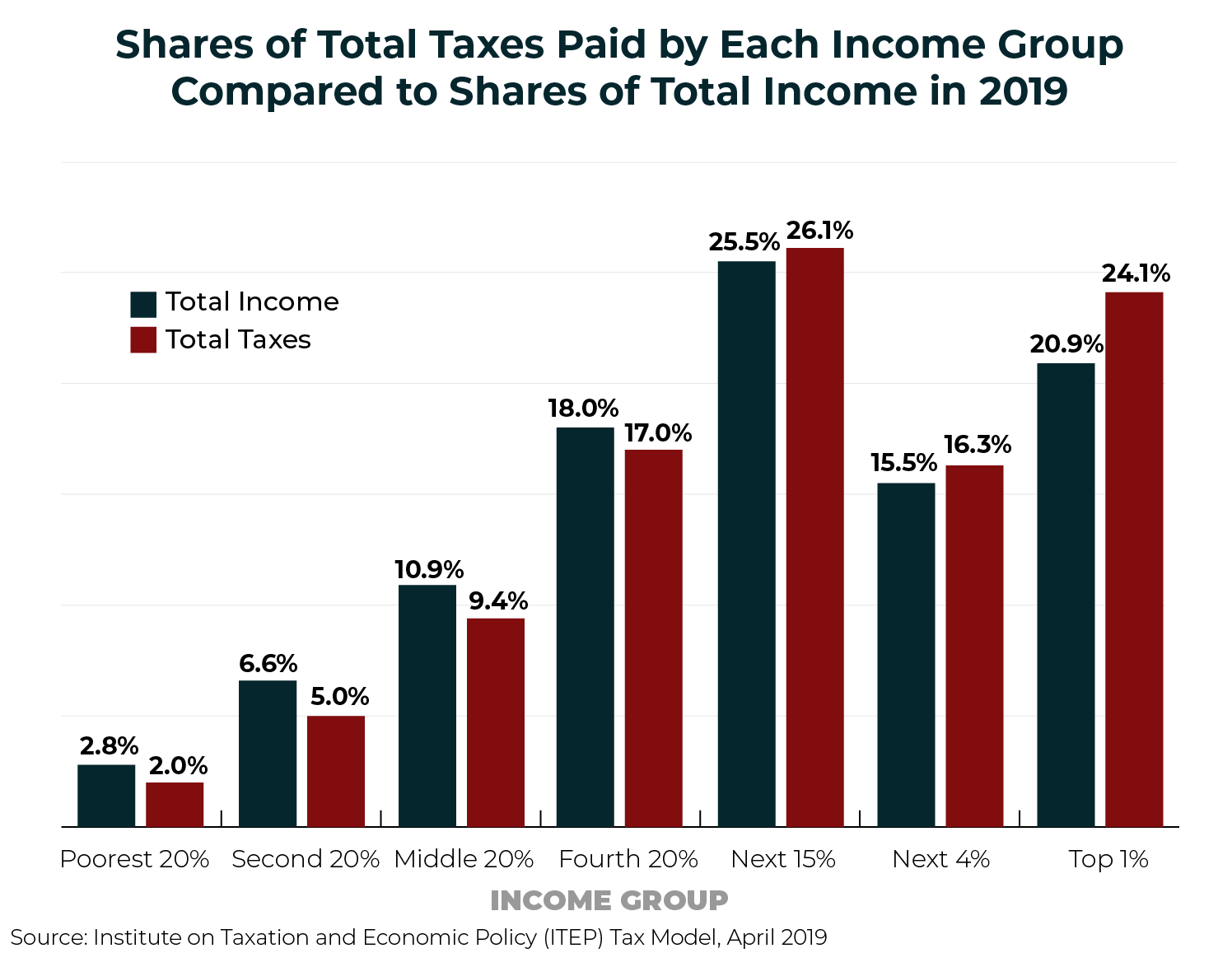

Top 10% of income earners pay 70% if income taxes. And we do not have an income problem. We have a spending problem.

| Quote : | | "I'd love to know how a payroll tax cut would help anything, even economically" |

More cash in small businesses hands (and out of the government) increases spending on things like payroll or equipment.

This has been our daily TWW Econ 101 lesson. 7/21/2020 1:13:54 PM 7/21/2020 1:13:54 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

| Quote : | | "Top 10% of income earners pay 70% if income taxes" |

And what percent of the wealth do they own?

| Quote : | | "More cash in small businesses hands (and out of the government) increases spending on things like payroll or equipment." |

The economy isn't catering bc of people with jobs, it's bc of the tens of millions unemployed. A payroll tax cut doesn't pay their rent or give them income. 7/21/2020 1:23:49 PM 7/21/2020 1:23:49 PM

|

A Tanzarian

drip drip boom

10991 Posts

user info

edit post |

| Quote : | | "Top 10% of income earners pay 70% if income taxes" |

Oh, the injustice!

7/21/2020 1:24:01 PM 7/21/2020 1:24:01 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

Even that is misleading bc people like bezos arent paying income tax on the billions they make every day, not to mention corporate taxes

[Edited on July 21, 2020 at 1:30 PM. Reason : E]  7/21/2020 1:29:58 PM 7/21/2020 1:29:58 PM

|

A Tanzarian

drip drip boom

10991 Posts

user info

edit post |

no argument there  7/21/2020 1:45:12 PM 7/21/2020 1:45:12 PM

|

HCH

All American

3895 Posts

user info

edit post |

| Quote : | | "Even that is misleading bc people like bezos arent paying income tax on the billions they make every day, not to mention corporate taxes" |

Is Bezos not paying income taxes? You probably don't have a source on that because the IRS would be all over that. But you probably mean corporate income tax, even though you don't really know the difference.

| Quote : | | "The economy isn't catering bc of people with jobs, it's bc of the tens of millions unemployed. A payroll tax cut doesn't pay their rent or give them income." |

The economy is precisely cratering because of unemployment. A payroll tax cut allows employers to hire more employees (or spend on capital expenditures). And look here, your evil Amazon just announced they will be doubling the number of new employees in the Garner facility to 3,000. FYI, giving people jobs is actually better than a government program just paying their rent.

https://www.newsobserver.com/news/business/article244375442.html#storylink=hpdigest_local 7/21/2020 2:22:12 PM 7/21/2020 2:22:12 PM

|

marko

Tom Joad

72744 Posts

user info

edit post |

not credible  7/21/2020 2:35:18 PM 7/21/2020 2:35:18 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

| Quote : | | "Is Bezos not paying income taxes? You probably don't have a source on that because the IRS would be all over that. But you probably mean corporate income tax, even though you don't really know the difference" |

A couple points

1) go fuck yourself

2)if you're still reading i never said he "doesn't pay income tax" although his "income" in that vein is minimal compared to his wealth

3) before you say it, I also didn't say he doesn't pay any tex on that wealth but whatever he does pay is likely far less than the effective income tax rate for that amount

4) is actually DO know what Amazon pays in corporate income tax because it's publicly disclosed. Again, very low compared to citizens effective tax rates

The rest of your post discusses drops in the bucket for our current unemployment. A payroll tax cut won't even make a dent. Amazon hiring 3000 people won't make a dent. Also how many of those 3000 are now underemployed and/or got a job there bc their small business went under already? And with Amazon's safety record, how many cases of Corona are they giving out with those 3000 jobs? 7/21/2020 2:48:07 PM 7/21/2020 2:48:07 PM

|

HCH

All American

3895 Posts

user info

edit post |

You complain of unemployment and a company announces they will be hiring double what they expected, and you complain the company isn't doing it right because no real reason. You people are impossible to deal with.

| Quote : | | "Amazon hiring 3000 people won't make a dent." |

Tell that to the 3000 people who now have an income. But you dont really care about people. You just care about your ideology of a large central government making all decisions for you. 7/21/2020 3:05:53 PM 7/21/2020 3:05:53 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

You are not understanding the world if you're thinking of this as two sides of a coin, they are not mutually exclusive. Great for those people that got jobs (or at least better than NO jobs), but what about the other 10 million? Amazon can't hire them all at least not yet.

But yes it expect any employer to keep their employees safe, that's one of the beeline expectations of modern society. If they can't the government should step in a keep thoae people with roofs over their heads at least until the pandemic is over. The entire point of the government is to keep society going and provide the groundwork for the pursuit of happiness. Hell I'd even be fine if they did a better job of paying businesses to hibernate but keep people employed! (with tons of oversight of course)

[Edited on July 21, 2020 at 3:16 PM. Reason : E]  7/21/2020 3:15:53 PM 7/21/2020 3:15:53 PM

|

thegoodlife3

All American

38908 Posts

user info

edit post |

Amazon deserves no praise or celebration over anything  7/21/2020 3:22:30 PM 7/21/2020 3:22:30 PM

|

NyM410

J-E-T-S

50084 Posts

user info

edit post |

| Quote : | | " The economy is precisely cratering because of unemployment. A payroll tax cut allows employers to hire more employees (or spend on capital expenditures)." |

That’s the theory. We spent all of 2018-19 waiting for that pickup in CapEx and got... lots of stock buybacks. 7/21/2020 3:22:59 PM 7/21/2020 3:22:59 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

It's also completely different now. Unemployment isn't high bc of taxes, it's bc of a fucking pandemic! Comparing now to normal with some snide "econ 101" bullshit seems wildly off base  7/21/2020 3:59:25 PM 7/21/2020 3:59:25 PM

|

horosho

Suspended

2001 Posts

user info

edit post |

I'm not sure about that. I think a lot of the jobs are gonna be gone for good. Many businesses have figured out ways to be more efficient during the pandemic and do everything with fewer workers. Some have used the pandemic as an excuse to cut down. I think the economy is "restructuring" instead of "cratering". More business will be done remotely online now requiring less support staff.

AI and robotics are lurking...  7/21/2020 4:10:26 PM 7/21/2020 4:10:26 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

You're not sure about what, man? Who are you even responding to?  7/21/2020 4:27:42 PM 7/21/2020 4:27:42 PM

|

Cherokee

All American

8264 Posts

user info

edit post |

| Quote : | "Trying to understand both points here.

Payroll tax cut...meaning cutting taxes that business owners pay?

Based on this, i dont see how a payroll tax cut would fix anything, but I could be missing something." |

So the payroll tax cut should result in additional expendable income in a worker's paycheck. It is by NO means significant but it does result in additional cash. If I recall, back when Bush instituted one of these I was, at the time making somewhere between 24k and 40k a year (I can't recall if I was still in politics or had moved on to financial services) and after the payroll tax cut I ended up getting I think an additional $40 per paycheck.

| Quote : | | "Top 10% of income earners pay 70% if income taxes. And we do not have an income problem. We have a spending problem." |

It doesn't matter if they pay 70% of all taxes collected - we aren't collecting enough taxes period to fund the things needed in this nation. This is not about fairness, i.e., the "fair" argument regarding whether those making more should be taxed simply because they make more. This is simply reality. We have X amount of total cash in this nation and we have needs that have to be met. The number of people holding that X amount of cash is reducing every year and the needs that have to be met are not. It's simple arithmetic.

Are there problems in spending? Absolutely. DOD budget is, by the pentagon's OWN admission nearly 25-35% waste. But you still cannot get around the simple fact that the money is pooling in fewer and fewer hands. If you want to build bridges, highways, fund science, education and the military then guess what? Money has to come from somewhere. And that's before even looking to things like Social Security, Medicare and Healthcare.

[Edited on July 21, 2020 at 4:44 PM. Reason : a] 7/21/2020 4:38:32 PM 7/21/2020 4:38:32 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

Wow people joke about not reading the last post but I def missed that quoted post

And maybe my original post needed more context that I thought was clear from the news cycle. Trump is insisting on this cut for a covid relief bill, however that cut should be very very low on anyone's list of priorities for covid, whether it be for sustainment or recovery.  7/21/2020 4:46:06 PM 7/21/2020 4:46:06 PM

|

HCH

All American

3895 Posts

user info

edit post |

| Quote : | | "Great for those people that got jobs (or at least better than NO jobs), but what about the other 10 million? Amazon can't hire them all at least not yet." |

It's as if Amazon isn't the only employer out there and we should create a favorable environment for the millions of other employers to create jobs.

| Quote : | | "Comparing now to normal with some snide "econ 101" bullshit seems wildly off base" |

There are still fundamental economic concepts that apply in just about every situation, including the one we are in now. One of those that you cant seem to grasp is that cash in individuals or businesses hands increases spending on payroll and equipment. So the lessons I am teaching you will continue.

| Quote : | | "We spent all of 2018-19 waiting for that pickup in CapEx and got... lots of stock buybacks." |

...And record low unemployment.

| Quote : | | "we aren't collecting enough taxes period to fund the things needed in this nation" |

LOL. The federal government collected $3.5 Trillion in revenue last year. Don't ever complain about wealth inequality again if you think that is not enough.

[Edited on July 21, 2020 at 4:57 PM. Reason : 1] 7/21/2020 4:53:47 PM 7/21/2020 4:53:47 PM

|

horosho

Suspended

2001 Posts

user info

edit post |

| Quote : | | "We have X amount of total cash in this nation and we have needs that have to be met. The number of people holding that X amount of cash is reducing every year and the needs that have to be met are not. It's simple arithmetic." |

Not. how. it. works.

Please stop spreading this paygo nonsense, Pelosi.

[Edited on July 21, 2020 at 5:10 PM. Reason : fyi don't watch the briefings on MSM, they will cut out Trump so they can tell you what he said] 7/21/2020 5:07:06 PM 7/21/2020 5:07:06 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

A payroll tax cut will rehire 10million people that were laid off bc in the last 3 months bc taxes are too high. Solid economic theory.

A favorable environment requires near eradication of covid and/or a vaccine, until then the tax rate is pretty close to a moot issue.  7/21/2020 5:16:45 PM 7/21/2020 5:16:45 PM

|

HCH

All American

3895 Posts

user info

edit post |

| Quote : | | "And maybe my original post needed more context that I thought was clear from the news cycle. Trump is insisting on this cut for a covid relief bill, however that cut should be very very low on anyone's list of priorities for covid, whether it be for sustainment or recovery." |

I will be the first to admit that I did not get that context from your post, so I was just responding to the conversation re:the benefits of a payroll tax cut. I do agree with you that this situation (government shutting down entire industries due to COVID) insists on massive government support similar to what we saw with PPP and the increased unemployment benefits. I would even agree that these should be prioritized above a payroll tax cut. 7/21/2020 5:18:57 PM 7/21/2020 5:18:57 PM

|

Cherokee

All American

8264 Posts

user info

edit post |

| Quote : | | "LOL. The federal government collected $3.5 Trillion in revenue last year. Don't ever complain about wealth inequality again if you think that is not enough." |

If it was enough this discussion wouldn't be taking place now, would it?

| Quote : | "Receipts from individual income taxes, the largest source of revenues, rose by $34 billion

(or 2 percent). As a share of the economy, those receipts fell from 8.3 percent of GDP

in 2018 to 8.1 percent of GDP in 2019, remaining just above the 50-year average of

8.0 percent." |

GDP went up, income tax revenue went up and yet they represent a lower percentage of GDP. That means you are taxing less of the wealth accumulation. You cannot sustain anything in that fashion.

| Quote : | "Receipts from corporate income taxes, the third-largest source of revenues, increased by

$26 billion (or 12 percent) in 2019, rising from 1.0 percent of GDP to 1.1 percent. Those

revenues as a percentage of GDP remain among the lowest recorded since 2009 and below

the 50-year average of 1.9 percent of GDP. Those receipts include payments for activity in

both the 2018 and the 2019 tax years." |

GDP went up, corporate tax revenue went up and represents an increasingly lower percentage of GDP. That means you are taxing less wealth accumulation. You cannot sustain anything in that fashion.

| Quote : | "Estate and gift taxes decreased by $6 billion (or 27 percent), reflecting changes

made by the 2017 tax act, which doubled the value of the estate tax exemption." |

This is also incredibly unhelpful.

https://www.cbo.gov/system/files/2019-11/55824-CBO-MBR-FY19.pdf

Which brings us back to my original point - sane wealth taxation.

[Edited on July 21, 2020 at 6:20 PM. Reason : forgot the estate tax]

[Edited on July 21, 2020 at 6:26 PM. Reason : clarified one part]

[Edited on July 21, 2020 at 6:26 PM. Reason : a] 7/21/2020 6:11:29 PM 7/21/2020 6:11:29 PM

|

GenghisJohn

bonafide

10226 Posts

user info

edit post |

so he is pivoting from saying covid is going to go away, its going to disappear, i will be proven right -- to:

we have a crisis and sadly is going to get worse before it gets better

fucking wow. wonder how long his attention span lasts before he goes back to pretending covid will go away.  7/21/2020 6:23:44 PM 7/21/2020 6:23:44 PM

|

StTexan

Suggestions???

6031 Posts

user info

edit post |

^he also mentioned today that it will eventually disappear  7/21/2020 7:13:42 PM 7/21/2020 7:13:42 PM

|

HCH

All American

3895 Posts

user info

edit post |

| Quote : | | "If it was enough this discussion wouldn't be taking place now, would it?" |

Somehow, I feel like even a 100% tax rate would not be enough for you. 7/21/2020 7:20:48 PM 7/21/2020 7:20:48 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

| Quote : | | "I will be the first to admit that I did not get that context from your post, so I was just responding to the conversation re:the benefits of a payroll tax cut." |

Yea maybe I should have added more, but I guess, unlike you, i had more basic respect for the intelligence of my fellow TSBers despite how many disagree with or annoy the fuck out of me. I thought people would get that:

1) this is a Trump thread so my post was prob about Trump in some way

2) that Trump has been in the news stating he won't sign a Corona relief package without a tax cut

3) (and this may be my biggest mistake) that people had a grudging enough respect that that would know I understand the basic idea for why lower taxes could in theory be beneficial in normal times 7/21/2020 7:39:44 PM 7/21/2020 7:39:44 PM

|

thegoodlife3

All American

38908 Posts

user info

edit post |

^^ why do you cape up so much for the super wealthy?  7/21/2020 7:57:54 PM 7/21/2020 7:57:54 PM

|

Cherokee

All American

8264 Posts

user info

edit post |

^^^Well that's your problem. You make arguments based on how you feel rather than based on facts.  7/21/2020 8:02:21 PM 7/21/2020 8:02:21 PM

|

StTexan

Suggestions???

6031 Posts

user info

edit post |

| Quote : | | "Somehow, I feel like even a 100% tax rate would not be enough for you." |

Oh one of those people. Hey I can play too, I feel even a 0% tax rate would not be enough for you. 7/21/2020 8:03:07 PM 7/21/2020 8:03:07 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

| Quote : | | "“I just wish her well,” Trump says of Ghislaine Maxwell, who was arrested earlier this month and charged with facilitating Jeffrey Epstein’s alleged sexual exploitation and abuse of minor girls." |

7/21/2020 8:59:36 PM 7/21/2020 8:59:36 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

I thought he didn't know those people??

And mark the date. July 21st the first time this idiot told Americans to wear a mask.  7/21/2020 9:05:41 PM 7/21/2020 9:05:41 PM

|

Geppetto

All American

2157 Posts

user info

edit post |

I know this was much earlier on, but it needs to be addressed.

| Quote : | | "A payroll tax cut allows employers to hire more employees " |

This is incorrect. Hard stop. Any macroeconomic class makes this clear. Employers hire because the marginal profit from having an additional person is greater than equal to $1. i.e. they are more profitable because of hiring a person. Taxes are done after the fact on profits, so even if taxes are 99%, the employer still has more in pocket than they otherwise would. Conversely if a person brings no extra profit to an employer, but the tax rate is 0%, an employer isn't going to hire people just to stand around just to make good on that tax windfall.

Hiring is a function of service demand when in context of the balance of capital and labor. Taxes are not part of that equation.

| Quote : | ""We spent all of 2018-19 waiting for that pickup in CapEx and got... lots of stock buybacks."

...And record low unemployment.

" |

Yes record unemployment happened but the conclusion there is a logical fallacy. Just because something happens afterward does not mean it is because of it- post hoc ergo propter hoc.

Unemployment had been falling at the same slope since 2011. The tax bill has no credible relation to it that I can see. I'm open to information pointing to the contrary. 7/22/2020 12:51:49 PM 7/22/2020 12:51:49 PM

|

NyM410

J-E-T-S

50084 Posts

user info

edit post |

There is no real explanation to the contrary.

The tax cut was SUPPOSED to allow companies to commit to CapEx and extend the business cycle. I mean, I sat in my office and read a certain sell side researcher talk about the coming CapEx boom for two years!

2018 CapEx was pretty flat and 2019 was down YoY. It just didn’t happen.

We did get a two quarter bounce on GDP and wealth was created via the market but real sustainable growth was never going to happen.

[Edited on July 22, 2020 at 1:50 PM. Reason : X]  7/22/2020 1:49:39 PM 7/22/2020 1:49:39 PM

|

HCH

All American

3895 Posts

user info

edit post |

| Quote : | | "Hiring is a function of service demand when in context of the balance of capital and labor. Taxes are not part of that equation" |

Taxes absolutely are part of the equation when they determine the amount of capital available. The explanation you provide above explains when a new employee is hired (profit > expense of hiring the new employee), but not the how (additional capital is available through increased profits or decreased operating costs). So I guess your comment was just a soft stop, because it only considered part of the equation.

| Quote : | | "Yes record unemployment happened but the conclusion there is a logical fallacy. Just because something happens afterward does not mean it is because of it- post hoc ergo propter hoc." |

Except, it's regularly shown to directly impact unemployment. So the logical fallacy does not apply. Unless you also want to say stock buybacks were actually not a result of increased capital either (which is also not true). Just be consistent in your argument.

| Quote : | | "The Joint Committee on Taxation (JCT) reported that the Tax Act would marginally increase the size of the economy and boost job creation." |

https://www.jct.gov/publications.html?func=startdown&id=5055 7/22/2020 5:18:08 PM 7/22/2020 5:18:08 PM

|

Geppetto

All American

2157 Posts

user info

edit post |

| Quote : | | " but not the how (additional capital is available through increased profits or decreased operating costs)" |

I think you misunderstand the cause and effect in place here. Increased rents do not drive new hiring. Prospect of increased rents as a result of new capital or labor are what drives hiring. At the risk of being reductive, let's say I have a business for which new employees cost me $5 and the store nets profits of $100. The tax rate in this world is 35%. No matter if the rate drops 30%, 15%, or 0%, netting an additional $5, $20, and $35 of profit, I am not going to hire the additional 1 - 7 employees unless doing so guarantees me more profit. Simply put, the lowered tax rate and resulting rise in profit doesn't create a need for hiring. Regardless of increased capital it is demand that drives hiring and not lowered tax rates. So, yes, hard stop.

Extending that scenario, but with a tax rate of 96% that only leaves me with $4 of capital, and not enough to hire another employee. This is an extreme and unlikely scenario, but an extreme worthy of testing. Moving the tax rate lower doesn't influence hiring unless there is demand to drive hiring.

Let's assume demand is strong enough to hire, but I only have $4 and the employee costs $5. This does not pose a problem. Investing in labor, capital, and projects are forward looking events based on the prospect of additional rent. A logical owner would invest in hiring the employee- not much different than starting a business from scratch with 0 revenue but hiring people generates revenue- because the profit from hiring that person moves revenue from $4 to $4+(revenue - costs).

| Quote : | | "Except, it's regularly shown to directly impact unemployment. So the logical fallacy does not apply. Unless you also want to say stock buybacks were actually not a result of increased capital either (which is also not true). Just be consistent in your argument." |

Then please share firm examples of how lowering taxes regularly impacts unemployment, because that is evidence many of us here are missing.

In fact I asked for such:

| Quote : | | "Unemployment had been falling at the same slope since 2011. The tax bill has no credible relation to it that I can see. I'm open to information pointing to the contrary." |

I pointed to a consistent slope in unemployment from 2011 to 2020 as evidence that an association between the tax cut didn't impact job growth momentum in at least this scenario, despite record levels coming after them. Stock buyback on the other hand had an increase in slope, not proving a connection after the fact but at least providing evidence toward the claim. 7/22/2020 9:03:31 PM 7/22/2020 9:03:31 PM

|

HCH

All American

3895 Posts

user info

edit post |

You aren’t understanding. Of course demand drives new hires, nobody is arguing that. What you are missing is the rest of the equation. Additional capital facilitates the the new hires.

And I provided a real life example above.  7/22/2020 9:45:09 PM 7/22/2020 9:45:09 PM

|

Geppetto

All American

2157 Posts

user info

edit post |

Additional capital does not because it is not needed to do so. The costs of the labor are accounted for by the excess rents. Existing capital is not a requirement here.  7/22/2020 9:59:33 PM 7/22/2020 9:59:33 PM

|

HCH

All American

3895 Posts

user info

edit post |

Scitovsky would disagree:

| Quote : | " Finally, we have shown that the secular accumulation of capital equipment and

of securities is likely to lead to increasing unemployment even if prices and

costs are not perfectly rigid (but their flexibility is limited by the requirement

of stability), unless employment is maintained by population growth, technical

advance, increasing quantity of money, or by at least one of these factors" |

https://www.jstor.org/stable/pdf/2967464.pdf

Perhaps it would help if you went back to your professor and asked him to explain the function of capital on new employment. 7/23/2020 9:45:27 AM 7/23/2020 9:45:27 AM

|

Geppetto

All American

2157 Posts

user info

edit post |

It may be best if you share your premise, because the more 'support' you aim the provide the more your premise becomes unclear, while not providing any actual support.

Example: I assumed your premise to be that tax cuts create jobs and are responsible for creating record unemployment and are a direct influence on hiring. I assumed this because of your statements that:

| Quote : | | "More cash in small businesses hands (and out of the government) increases spending on things like payroll or equipment." |

and

| Quote : | | "...And record low unemployment." |

My premise was: Tax cuts do not reduce unemployment and and is demand that does. I proceeded to provide examples of how demand influences hiring and how taxation influences nothing without demand - i.e. demand is responsible not tax rate. I also used to slope of unemployment before and after the tax cut to further show that there is no proof the cuts changed anything.

It seemed you then augmented your premise to: yes demand is the root cause, but that now tax cuts accelerate hiring rather than being the cause of it.

I then doubled down on my original premise, providing context of how in an environment that is both demand and tax heavy that hiring still takes place and at the same rate because hiring is about the profit a new hire brings you, not how much money you have in the bank (which would be influenced by a shift in tax rates).

You then shared a single quote from a an 80 year old book whose context is largely why is capitalism good and non-capitalist societies bad. Motives and age of the text aside, the selected quote doesn't refute anything that I have said. Increasing quantity of money, yes, but as is done through additional profits and employer gets to have by employing an individual. This is a central tenet of capitalism, which applies in the context of the book's theme, and supports exactly what I stated. Those profits may be bigger or lower based on tax rate, but increased profits at all is what drives shift in unemployment. Simply put, this relationship is the function of capital labor.

If you still have issue with this, please do share with us your premise, so that we can address it. 7/23/2020 12:32:43 PM 7/23/2020 12:32:43 PM

|

wdprice3

BinaryBuffonary

45908 Posts

user info

edit post |

lol, tax cuts having a [significant] affect on hiring. companies don't hire because of tax rates. Laborers cost money, lots of it. Hiring happens when: labor demand/labor available >1 and profit/laborer cost > 1

Hey, the gubmit lowered our tax rate! Let's unnecessarily hire people that we have nothing for them to do!  7/23/2020 12:48:23 PM 7/23/2020 12:48:23 PM

|

HCH

All American

3895 Posts

user info

edit post |

^^Look, I've provided a real life example and an academic article (which is the foundation of labor theory.

If you have issues with it, take it up with the economic academics that still cite it today) that supports my position. I don't really have much more to discuss around this, unless you can provide the same substantive support for your position. I report, you decide.

Also, I think you are unclear on rents and capital. Capital is a part of economic rent, they are not distinct from each other.

^That has not been argued in this thread at all. Try to keep up.  7/23/2020 2:17:30 PM 7/23/2020 2:17:30 PM

|

rwoody

Save TWW

36999 Posts

user info

edit post |

Trump paid me to post about the payroll tax in a vague enough manner to derail this thread. Cashing my check!  7/23/2020 2:25:25 PM 7/23/2020 2:25:25 PM

|

Geppetto

All American

2157 Posts

user info

edit post |

^^What real life example? Are you discussing the Garner plant? If so, yes, you posted an example of a company hiring people but that report no way connects to taxes. The article does, in fact, state this:

| Quote : | | " But since the coronavirus pandemic has changed the spending habits of millions of Americans, Amazon has pumped up its staffing levels to keep pace with the increased reliance on online shopping." |

That is, demand shifted, so they are hiring more. No implication that the tax code has permitted them to do so.

Regarding the academic paper, I explained how even though there are reasons why that may not be the most valid source that it, much like the article, doesn’t support what we believe to be your premise. If our understanding of your premise is wrong, then please share and then we can reflect on it with new context. But otherwise, it sounds like your one step away from drawing on a week old map with a sharpie to defend your point.

As to rents vs. capital. Rents refer to the economic gains, whereas capital can include cash and/or machinery. My usage is correct and intention as to remove ambiguity.

I’m truly open to any information you have that actually supports any of the claims you’ve made or any premise (original, adjusted, or something entirely new) that you have. All that’s being asked is that you present it and that it actually supports the premise.

I’m not even asking you to refute my points, just support your own. 7/23/2020 2:38:38 PM 7/23/2020 2:38:38 PM

|

HCH

All American

3895 Posts

user info

edit post |

| Quote : | | "Rents refer to the economic gains" |

So you agree that rents includes capital...which is my entire argument.

| Quote : | | "What real life example? " |

Quote :

"The Joint Committee on Taxation (JCT) reported that the Tax Act would marginally increase the size of the economy and boost job creation."

https://www.jct.gov/publications.html?func=startdown&id=5055 7/23/2020 3:39:58 PM 7/23/2020 3:39:58 PM

|

thegoodlife3

All American

38908 Posts

user info

edit post |

| Quote : | " mar·gin·al·ly

/'märj?n?le/

adverb

to only a limited extent; slightly." |

7/23/2020 3:50:42 PM 7/23/2020 3:50:42 PM

|

HCH

All American

3895 Posts

user info

edit post |

That's what you got from that report? Let me guess, you didn't actually read the report because it conflicts with your world view. Sit down.  7/23/2020 3:53:50 PM 7/23/2020 3:53:50 PM

|

thegoodlife3

All American

38908 Posts

user info

edit post |

you literally posted that it would marginally increase the size of the economy and boost job creation  7/23/2020 4:02:00 PM 7/23/2020 4:02:00 PM

|

A Tanzarian

drip drip boom

10991 Posts

user info

edit post |

Are we talking about changes in the payroll tax or changes in income tax?  7/23/2020 4:12:31 PM 7/23/2020 4:12:31 PM

|

HCH

All American

3895 Posts

user info

edit post |

Where in this thread do I comment on how much of an impact a tax cut would have on unemployment? In fact, I agreed with rwoody's clarification that in the context of COVID, it should not have priority over other things like PPP or increased unemployment benefits because it would not have the impact that those other programs would. But the literature and real life data do confirm that, in general, tax cuts (and therefore available capital) do impact hiring decisions.

[Edited on July 23, 2020 at 4:15 PM. Reason : The original discussion was about the payroll tax.]  7/23/2020 4:14:20 PM 7/23/2020 4:14:20 PM

|

thegoodlife3

All American

38908 Posts

user info

edit post |

set em up  7/23/2020 4:23:52 PM 7/23/2020 4:23:52 PM

|