PaulISdead

All American

8561 Posts

user info

edit post |

Thanks obama  2/6/2019 8:09:31 PM 2/6/2019 8:09:31 PM

|

PaulISdead

All American

8561 Posts

user info

edit post |

2/6/2019 8:41:12 PM 2/6/2019 8:41:12 PM

|

dmspack

oh we back

25160 Posts

user info

edit post |

Isn’t this mostly due to withholding being less? So take home pay is a little more but that results in less of a refund later.

Or maybe I’m wrong. Idk.  2/6/2019 8:43:57 PM 2/6/2019 8:43:57 PM

|

PaulISdead

All American

8561 Posts

user info

edit post |

You are correct  2/6/2019 8:52:33 PM 2/6/2019 8:52:33 PM

|

dmspack

oh we back

25160 Posts

user info

edit post |

It’s amazing how voting preferences can change when you suddenly are the on directly impacted by a particular policy as opposed to being influenced by scare tactics with little direct impact on an individual (ISIS, illegal immigration, etc).  2/6/2019 8:57:50 PM 2/6/2019 8:57:50 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

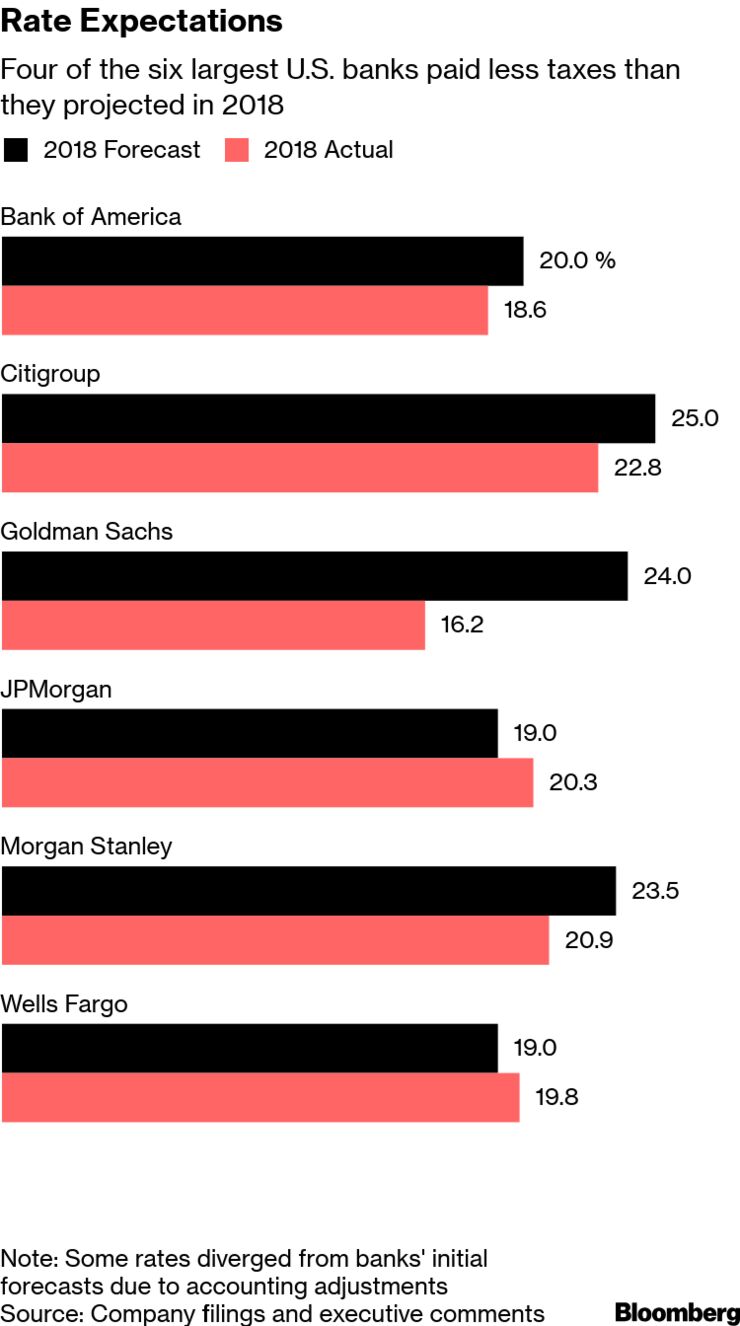

My tax rate might be lower this year (even if my withholding is all fucked up), but it ain’t Goldman Sachs low. I’d stab a man to get a 16% tax rate.

2/7/2019 8:54:39 AM 2/7/2019 8:54:39 AM

|

sawahash

All American

35321 Posts

user info

edit post |

Got married last year and bought a house. Thought we would get a good refund, but damn it sucks this year. I honestly am not educated enough to know how the current administration has affected this, but something is different this year than years past.

I mean I don't know if getting married changed anything and put us in a different tax bracket. I have no idea. I don't have enough time to figure this out. I just go on turbotax and fill in all the blanks.

Maybe next year we will pay someone to do our taxes for us.  2/8/2019 4:57:02 PM 2/8/2019 4:57:02 PM

|

Crede

All American

7337 Posts

user info

edit post |

^https://www.fool.com/taxes/2018/09/13/3-reasons-your-higher-2018-standard-deduction-migh.aspx  2/8/2019 9:57:17 PM 2/8/2019 9:57:17 PM

|

wwwebsurfer

All American

10217 Posts

user info

edit post |

^^

Married filing jointly the standard deduction is $24K. Median household income in the US is around $75K. If you're roundabout average it takes some effort for people with regular day jobs to make it into itemizing, which used to be pretty normal for anyone who regularly gave to charity or recently purchased a house and paid a lot of interest (this is the "simplification" of the tax code most people will see.)

Not receiving a large refund is the ideal situation. Your W-4 should be tuned to target the smallest possible refund. Its your money they're holding - you're putting it into a savings account that earns zero interest. If you "depend" on refunds for vacation fund or other things, I would suggest automating a transfer to an account you won't touch.

Long story short is system working as designed. You retained a few extra bucks (for me about 2.5%) on every paycheck throughout the year.  2/9/2019 2:48:35 AM 2/9/2019 2:48:35 AM

|

NeuseRvrRat

hello Mr. NSA!

35376 Posts

user info

edit post |

Every year I up my withholding to try and break even, and every year I still have to pay. Better than getting a refund, though.  2/9/2019 6:45:35 AM 2/9/2019 6:45:35 AM

|

scud

All American

10803 Posts

user info

edit post |

The Goldman Sachs number is very misleading(full disclaimer, they are my employer) due to early repatriation of foreign held cash in Q4'17 that resulted in an enormous tax bill for that quarter. The effects of that repatriation bled over into 18. Expect next year to see numbers that are more in line with the other banks.

https://www.goldmansachs.com/media-relations/press-releases/current/pdfs/2017-q4-results.pdf

Provision for Taxes

The effective income tax rate for 2017 was 61.5%, up from 22.6% for the first nine months of 2017

and up from 28.2% for full year 2016, reflecting the impact of Tax Legislation (1). Excluding Tax

Legislation, the effective income tax rate for 2017 was 22.0% (8).

[Edited on February 9, 2019 at 4:52 PM. Reason : .]  2/9/2019 4:33:24 PM 2/9/2019 4:33:24 PM

|

OmarBadu

zidik

25060 Posts

user info

edit post |

A bit surprised college grads would be widely surprised about what they will pay in taxes  2/9/2019 5:33:33 PM 2/9/2019 5:33:33 PM

|

jakis

Suspended

1415 Posts

user info

edit post |

teachers are dumb  2/10/2019 9:55:47 AM 2/10/2019 9:55:47 AM

|

synapse

play so hard

60908 Posts

user info

edit post |

| Quote : | | "Not receiving a large refund is the ideal situation. Your W-4 should be tuned to target the smallest possible refund. Its your money they're holding - you're putting it into a savings account that earns zero interest" |

Why not max your allowances then? Why not just keep most of your money in an interest bearing account and pay your bill each year? 2/10/2019 11:08:49 AM 2/10/2019 11:08:49 AM

|

A Tanzarian

drip drip boom

10991 Posts

user info

edit post |

You can be penalized for not withholding enough.  2/10/2019 11:50:46 AM 2/10/2019 11:50:46 AM

|

dtownral

Suspended

26632 Posts

user info

edit post |

I usually work out pretty neutral but I did the allowance work sheet this year knowing taxes were changing and it bumped me way up, much higher than I needed.  2/10/2019 11:52:09 AM 2/10/2019 11:52:09 AM

|

NeuseRvrRat

hello Mr. NSA!

35376 Posts

user info

edit post |

^^iirc, the penalty is only a few bucks  2/10/2019 1:44:34 PM 2/10/2019 1:44:34 PM

|

beatsunc

All American

10650 Posts

user info

edit post |

child credit going from $1k to $2k would be nice if my baby momma didnt claim it every year so i cant   2/10/2019 7:16:08 PM 2/10/2019 7:16:08 PM

|

Shivan Bird

Football time

11094 Posts

user info

edit post |

I'm paying $2397 less because of the new law. Most of the people paying more are those with large state & local tax deductions, which are now capped at $10,000.  2/10/2019 10:00:34 PM 2/10/2019 10:00:34 PM

|

The Coz

Tempus Fugitive

24420 Posts

user info

edit post |

I owe money at filing for the first time. Just below $1000 federal. I've adjusted my withholding / allowances in the past targeting as small a refund as possible, which worked pretty well. However, I did not work through a new W-4 worksheet in 2018 despite the tax law changes, so I am guessing that the fact that I owe is due to adjustments in the withholding tables. I had similar W-2 income in 2018 as compared to 2017, but I can see that a lot less was withheld throughout the year. My fault, I guess. A lot of the people getting mad about owing a tax bill or getting a smaller refund at filing don't seem to grasp this. That said, if you rely on a refund, I suppose it comes as a shock, and the possible need to make W-4 adjustments was not very well publicized in national outlets. I went ahead and adjusted withholdings last week to avoid potential underpayment penalties.  2/11/2019 6:52:48 AM 2/11/2019 6:52:48 AM

|

FroshKiller

All American

51877 Posts

user info

edit post |

Withholding is just giving the government an interest-free loan.  2/11/2019 8:13:09 AM 2/11/2019 8:13:09 AM

|

beatsunc

All American

10650 Posts

user info

edit post |

Withholding is just a trick to steal money without people noticing  2/11/2019 8:23:41 AM 2/11/2019 8:23:41 AM

|

CaelNCSU

All American

6883 Posts

user info

edit post |

^^ A counter argument to that is most people don't invest or save and would just spend the money anyway.  2/11/2019 8:48:27 AM 2/11/2019 8:48:27 AM

|

NeuseRvrRat

hello Mr. NSA!

35376 Posts

user info

edit post |

If you're not going to invest in something with a return that beats inflation, then spending is technically better than sitting on cash.  2/11/2019 10:43:04 AM 2/11/2019 10:43:04 AM

|

Wolfey

All American

2607 Posts

user info

edit post |

I am guessing that the tweets from the second post are all people living in States with high income taxes that used to be able to deduct that from your federal taxes.

I saw about the same deducted from my paycheck I might have taken home slightly more, not a ton more. My refund was bigger this year but not much bigger. Though I live in Georgia and our state income tax rate isn't as high as the Northeast or California.  2/11/2019 12:09:03 PM 2/11/2019 12:09:03 PM

|

ncsuallday

Sink the Flagship

9817 Posts

user info

edit post |

I usually get about $2k back but this year owe money for the first time ever. Part of it probably has to do with not adjusting my allowances when I was between my old house and new one for ~6 months (less mortgage interest to deduct) but still wouldn't have imagined it to be so much of a difference.  2/11/2019 1:08:43 PM 2/11/2019 1:08:43 PM

|

wolfpack0122

All American

3129 Posts

user info

edit post |

My income went up in 2018 and my taxes went down. By a lot. Mostly due to the extra $1,000 tax credit for each kid and we have 3 kids. A good portion of my income comes in the form of bonuses which are inconsistent and have more taxes taken out of them, so I've stopped trying to figure out how to not get a refund and not owe much money and just take the refund.

2017 I had $10,137 in federal taxes taken out of my paycheck

2018 I had $7,870 in federal taxes taken out of my paycheck and my refund went up ~$1,000 compared to 2017  2/11/2019 8:34:56 PM 2/11/2019 8:34:56 PM

|

dmspack

oh we back

25160 Posts

user info

edit post |

i'm assuming my taxes are gonna be...not great.

got married in 2018, so we combined incomes. i was previously using ACA for healthcare, getting a decent rate based on my single income...so i'm gonna be paying it back now.  2/12/2019 6:31:29 AM 2/12/2019 6:31:29 AM

|

dtownral

Suspended

26632 Posts

user info

edit post |

isn't married filing jointly the highest standard deduction?  2/12/2019 9:01:42 AM 2/12/2019 9:01:42 AM

|

beatsunc

All American

10650 Posts

user info

edit post |

^if both people work the mofo's add your income together to put you in a higher bracket  2/12/2019 6:21:36 PM 2/12/2019 6:21:36 PM

|

dmspack

oh we back

25160 Posts

user info

edit post |

^^if you’re directing that at me, the reason I’m gonna owe so much is because my health insurance rate for 2018 was based on my single income. We got married in October and I got on my wife’s insurance through her work. When we file it’ll combine our 2018 incomes and I’ll have to pay back the premium tax credit (which lowered my insurance premiums quite a bit) that was based on my individual income.  2/12/2019 7:06:40 PM 2/12/2019 7:06:40 PM

|

dtownral

Suspended

26632 Posts

user info

edit post |

^^brackets are higher if you file jointly, basically double vs filing separately

[Edited on February 13, 2019 at 9:28 AM. Reason : .]  2/13/2019 9:16:33 AM 2/13/2019 9:16:33 AM

|

wwwebsurfer

All American

10217 Posts

user info

edit post |

^^^ yes... but both the brackets and the standard deductions are doubled up.

This is the first year I've seen where the progression for a married couple is totally linear. Previously it was possible to fall into a gap where filing separately could save you a few bucks. Generally I chalk 98% of this up to people not understanding how a progressive tax is applied when you're $1000 into a higher tax bracket you only pay the higher rate on the $1000, but if you had kids or sold property or had an inheritance it could make a difference.

https://www.investors.com/wp-content/uploads/2018/11/TAX-brackets-eg-768x332.jpg

If the image loads you'll see that in 2018 it should make no difference by joint filing with simple returns below a half million. But in 2017, that hole is above $150K, which isn't inconceivable income for 2 professionals. When you combine this with a general misunderstanding about how progressive taxes work (many think the brackets work like a flat tax  )... some people swear filing separate is better. )... some people swear filing separate is better.

[Edited on February 14, 2019 at 1:57 AM. Reason : adjusting ^ for miscount]  2/14/2019 1:53:49 AM 2/14/2019 1:53:49 AM

|

Geppetto

All American

2157 Posts

user info

edit post |

| Quote : | | "98% of this up to people not understanding how a progressive tax is applied when you're $1000 into a higher tax bracket you only pay the higher rate on the $1000" |

THIS

It gets me so often when people say they don't want to make more because they don't want to end up taking home less.

Now there are some areas where that makes sense, when someone is in a weird phase out for IRA deductions or student loans, etc.. but generally that isn't what these people are discussing. It baffles me how people think that a 38% tax rate means you are paying 38%. And how so many people will rant about something being unfair but have 0 clue how it actually operates.

fucking insane man 2/14/2019 1:46:07 PM 2/14/2019 1:46:07 PM

|

BJCaudill21

Not an alcoholic

8014 Posts

user info

edit post |

I really didn't understand it until I was probably in my mid 20s. And I even took accounting 1 & 2 where we had to do a tax return, but then again I didn't go to class a lot..  2/14/2019 1:57:28 PM 2/14/2019 1:57:28 PM

|

eleusis

All American

24527 Posts

user info

edit post |

The $10,000 limit on SALT deductions was painful to stomach this year.  2/14/2019 2:49:09 PM 2/14/2019 2:49:09 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

I feel like that's a #humblebrag  2/14/2019 2:58:54 PM 2/14/2019 2:58:54 PM

|

justinh524

Sprots Talk Mod

27167 Posts

user info

edit post |

I love when people bitch about getting a raise because it means they get bumped up into the next tax bracket. YOU'RE STILL MAKING MORE MONEY, THERE IS NO WAY THAT GETTING A RAISE MEANS YOU'RE MAKING LESS.  2/14/2019 3:49:34 PM 2/14/2019 3:49:34 PM

|

eleusis

All American

24527 Posts

user info

edit post |

^^it's more of a #fuckMD than a statement about my income. I added a dependent and my state taxes dropped accordingly, but my federal went up slightly.  2/14/2019 8:30:50 PM 2/14/2019 8:30:50 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

#fuckMD?

[Edited on February 14, 2019 at 9:46 PM. Reason : Leave McDonalds out of this!]  2/14/2019 9:46:06 PM 2/14/2019 9:46:06 PM

|

PaulISdead

All American

8561 Posts

user info

edit post |

fuck MD i had to pay an extra 1 percent for being a non resident about 10 years ago.  2/15/2019 8:41:35 PM 2/15/2019 8:41:35 PM

|

BridgetSPK

#1 Sir Purr Fan

31378 Posts

user info

edit post |

It's not a humblebrag. It's just eleusis doing literally what he always does always.

Also, synapse, nobody ever actually embraced the "humblebrag" terminology. It never caught on. You should just call people assholes.

Of course, eleusis already knows he's an asshole, but I still approve of you reminding him.  2/15/2019 10:28:13 PM 2/15/2019 10:28:13 PM

|

afripino

All American

11296 Posts

user info

edit post |

I fucks with the humblebrag verbage  2/15/2019 11:54:46 PM 2/15/2019 11:54:46 PM

|

justinh524

Sprots Talk Mod

27167 Posts

user info

edit post |

LOL y'all still paying taxes  2/16/2019 12:35:13 AM 2/16/2019 12:35:13 AM

|

scud

All American

10803 Posts

user info

edit post |

Its not a humblebrag if you live in a blue state. If that's the case then its more likely just a simple statement of fact.  2/16/2019 11:01:58 AM 2/16/2019 11:01:58 AM

|

Geppetto

All American

2157 Posts

user info

edit post |

This year when I did my taxes I realized the $5500 limit applies to family not the individual. Has it always been that way?  2/16/2019 11:15:28 AM 2/16/2019 11:15:28 AM

|

quiksilver

Veteran

766 Posts

user info

edit post |

This requires more clarification. The contribution limits for IRA/ROTH did not get combined to say spouses can only collectively contribute $5,500 as opposed to $5,500 per person. However, there may be other specific circumstances that changed this year for you that affected your deduction capabilities.  2/16/2019 11:33:33 AM 2/16/2019 11:33:33 AM

|

DonMega

Save TWW

4168 Posts

user info

edit post |

I had a 12.58% federal tax rate last year, 12.08% this year.

Changes from last year:

- I took the standard deduction this year

- child tax credit was higher (result of tax changes)

- $4k more towards HSA

- less pre-tax money allocated to 401k (higher contribution to roth)

- new job, slightly higher income

Things kinda balanced out for me. For reference, my overall tax rate without tax deductions/credits would have been around 17%  2/16/2019 3:09:02 PM 2/16/2019 3:09:02 PM

|

Nighthawk

All American

19597 Posts

user info

edit post |

Paying quite a bit more this year. Used to get several thousand back, and I took a number of deductions, so wasn't giving the government a free loan. But with my wife in school and a family of 4 I was getting some sweet tax credits. But since 2017 my salary alone has gone up 75% and my wife started working. No more EITC or shit like that. Still got around $1k back this year.  2/16/2019 7:39:26 PM 2/16/2019 7:39:26 PM

|

synapse

play so hard

60908 Posts

user info

edit post |

| Quote : | | "Paying quite a bit more this year" |

| Quote : | | "since 2017 my salary alone has gone up 75% " |

2/16/2019 9:39:50 PM 2/16/2019 9:39:50 PM

|